Why Fund Flows to China Financial ETFs Are Dwindling

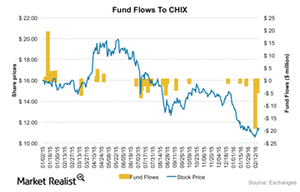

ETF investors have withdrawn almost $35.8 million from the Global X China Financials ETF (CHIX) (FXI) in the last six months.

Feb. 25 2016, Updated 10:06 a.m. ET

Fund flows

ETF investors have withdrawn almost $35.8 million from the Global X China Financials ETF (CHIX) (FXI) in the last six months. So far during the year, investors have pulled out $21.4 million from the CHIX fund. Concerns over the Chinese economy have been worrying investors in emerging markets. As a result, we are witnessing a flight of capital from developed economies.

Change in institutional investor holdings

Negative flows to the CHIX ETF correspond with a decline in trade activity of investors as seen by the 13F filings of major institutional asset managers.

In 4Q15, trade activity by 13F filers showed an 83.2% decline in aggregate shares held by institutional investors and hedge funds. Among the 20 13F filers holding the stock, six funds reduced their exposure to CHIX while four funds sold all their holdings in the ETF. In contrast, eight funds created new positions and two funds increased their exposure to the CHIX ETF.

Major institutional asset management firms like Citadel Advisors, KCG Holdings, Janney Montgomery Scott, and Bluefin Trading were the top net buyers of the CHIX ETF. Meanwhile, institutions like Janney Capital Management, Permal Asset Management, Jane Street Group, and Royal Bank of Canada (RY) sold their holdings of CHIX during the fourth quarter. Among these, Old Mission Capital liquidated all its exposure to CHIX while the others just reduced their holdings. Other funds to sell their holdings of CHIX included Citigroup (C), Wells Fargo (WFC), and BlackRock (BLK).