Royal Bank Of Canada

Latest Royal Bank Of Canada News and Updates

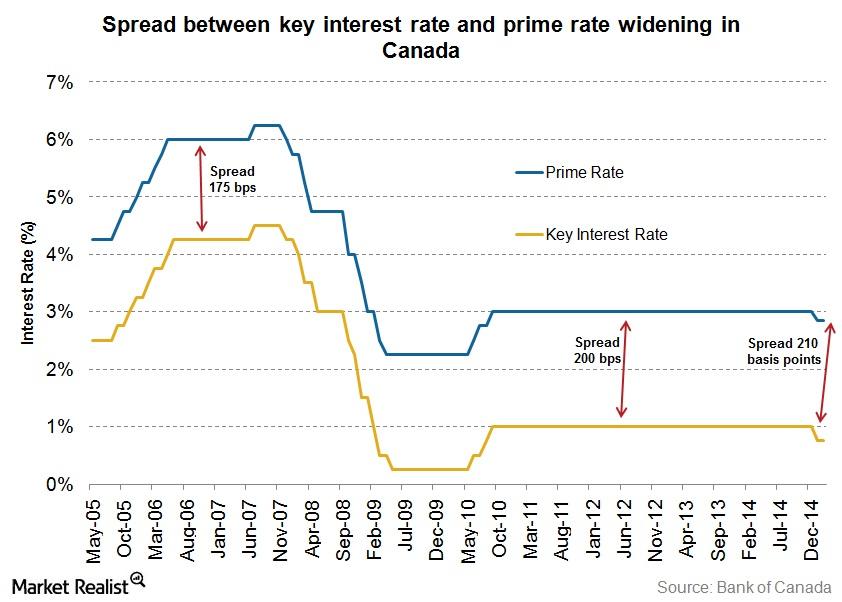

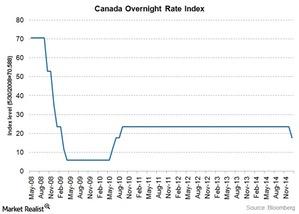

The widening spread in the Canadian prime and key interest rates

The “Big Six Banks” in Canada have only reduced their prime rates by 15 basis points. So the spread between the prime and key interest rates is now 0.1%.

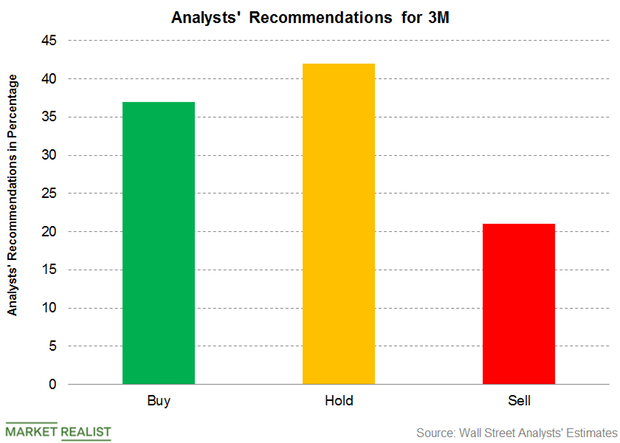

3M: Analysts Revised the Target Price

For 3M stock, 37% of the analysts recommended a “buy,” 42% recommended a “hold,” and 21% recommended a “sell.”

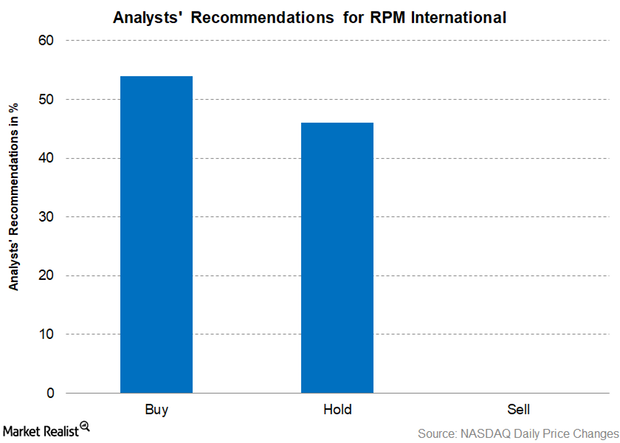

Analysts’ Consensus on RPM International

For RPM International, 54% of the analysts recommended a “buy,” 46% recommended a “hold,” and none of the analysts recommended a “sell.”

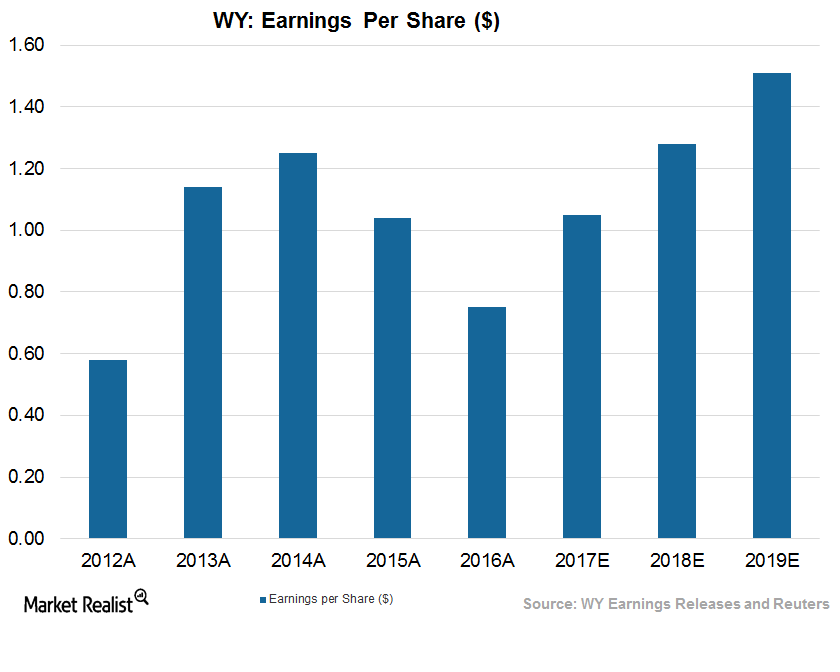

How Weyerhaeuser and Timberland REITs Came through the Fire

Timberland REITs (real estate investment trusts) in the US don’t seem to be in doubt about their continued growth momentum in the near future.

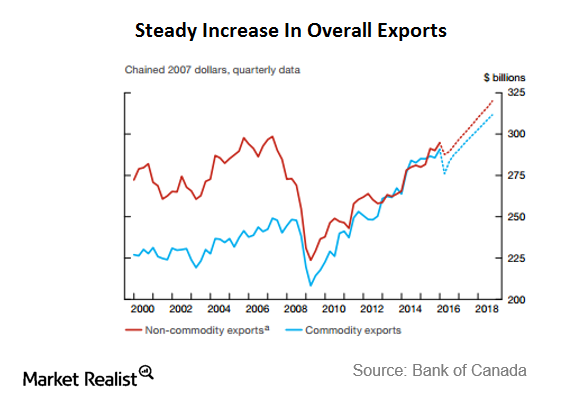

Major Takeaways from the Bank of Canada’s Monetary Policy

The Bank of Canada decided to keep the interest rates unchanged at 0.5% after the monetary policy meeting on July 13.

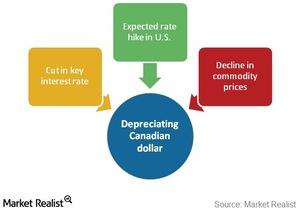

3 key factors affecting Canadian currency depreciation

The availability of easy money leads to currency depreciation, which benefits exporters, but is counterproductive for importers.

Economic essentials: The key interest rate and the prime rate

The key interest rate and the prime rate are central to the Canadian financial system. They key interest drives lending rates at the big banks.

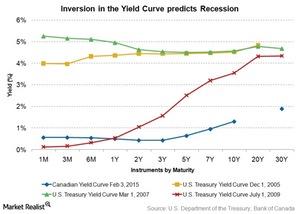

Could Canada’s inverted sovereign yield curve mean recession?

Canada’s inverted sovereign yield curve could be an indication of an upcoming recession. US yields exhibited similar curves prior to the 2008 recession.

Key challenges facing the Canadian economy

One of the challenges facing the Canadian economy is a lack diversification. More than 70% of the TSX Composite Index is made up of only three sectors.