Comparing Growth and Value Stock Sectors

The SPDR S&P 500 Growth ETF (SPYG) has generated a YTD return of 13.3% versus 4.3% from the SPDR S&P 500 Value ETF (SPYV).

June 22 2017, Updated 7:38 a.m. ET

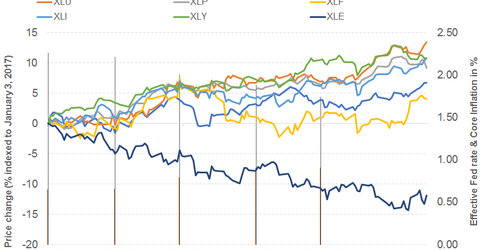

Growth versus value stock sectors

The SPDR S&P 500 Growth ETF (SPYG) has generated a YTD return of 13.3% versus 4.3% from the SPDR S&P 500 Value ETF (SPYV). Valued at a PE of ~20x, the SPDR S&P 500 Growth ETF has an annual dividend of 1.4%. The SPDR S&P 500 Value ETF, valued at a PE of ~16, offers an annual dividend of 2.3%. The success of the value stocks can be ascribed to the large-cap technology stocks including FANG. Energy and financial stocks dominate the value stock holdings.

Present fundamentals

The Fed’s quarter percent rate hike on June 14 preceded a decline in the Consumer Price Index and retail sales, partially offset by a rise in energy prices. The rate hike was followed by a decline in import prices and flat industrial production data on June 15.

Higher interest rates usually act as a dampener for real estate, utilities, and consumer staples. On the other hand, financials are the gainers during rising interest rates and therefore bear a negative correlation with the former three sectors. Industrials has the closest correlation with the S&P 500. The slowing fundamentals witnessed in the week ended June 16, therefore, aren’t a good sign for industrials.

The S&P 500 in the week ended June 16 was mainly driven by gains in industrials, utilities, real estate, and health care. This was offset by technology, consumer staples, materials, consumer discretionary, and energy. Technology, which recorded the highest gains on a YTD basis, suddenly came under investors’ scanner. Concerns about the sustainability of the rally of the tech firms and their overstretched valuations started brewing after Apple’s annual Worldwide Developers Conference on June 5, which was followed by a downgrade in Alphabet’s rating. The consequences of the investigation surrounding alleged Russian involvement in the election will play a crucial role in determining future US policies.

The iShares Core High Dividend ETF (HDV) and the Schwab US Dividend Equity ETF (SCHD) have recorded a YTD return of between 5%–7%. They have substantial exposure in consumer staples. The Schwab US Dividend Equity ETF (SCHD) also has substantial exposure in technology. ExxonMobil (XOM), Johnson & Johnson (JNJ), Procter & Gamble (PG), Coca-Cola (KO), Pfizer (PFE), Intel (INTC), and Verizon (VZ) form important holdings of the ETFs. Both offer an annual dividend of ~3% at a PE ratio of 20x–21x.

The PowerShares S&P 500 High Dividend Low Volatility Portfolio ETF (SPHD), which generated a YTD return of 6%, offers an annual dividend of ~4% at a PE ratio of 15x. It has a substantial exposure in utilities followed by real estate. Welltower (HCN), Philip Morris International (PM), Iron Mountain (IRM), and Ventas (VTR) form important holdings of the ETF.