Iron Mountain Inc

Latest Iron Mountain Inc News and Updates

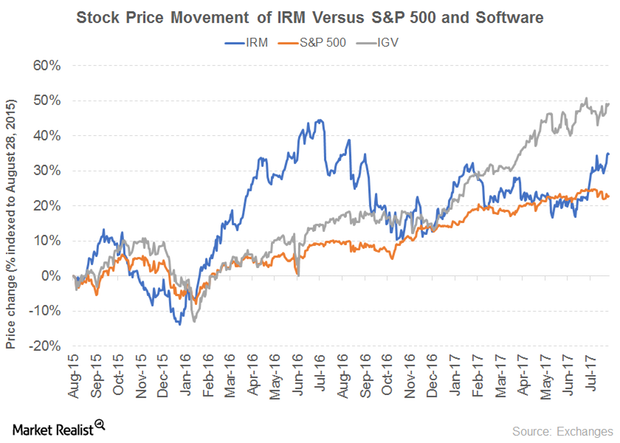

How Iron Mountain Has Maintained Its Dividend Yield

How Iron Mountain has maintained a 5% yield Iron Mountain (IRM) is an enterprise information management services company. The company’s revenue grew in 2016, supported by its North American Records and Information Management Business, North American Data Management Business, Western European Business, and Other International Business segments. Its revenue fell 4% in 2015 before rising 17% in 2016. Its operating income fell 5% in 2015 and 4% in 2016 due to […]

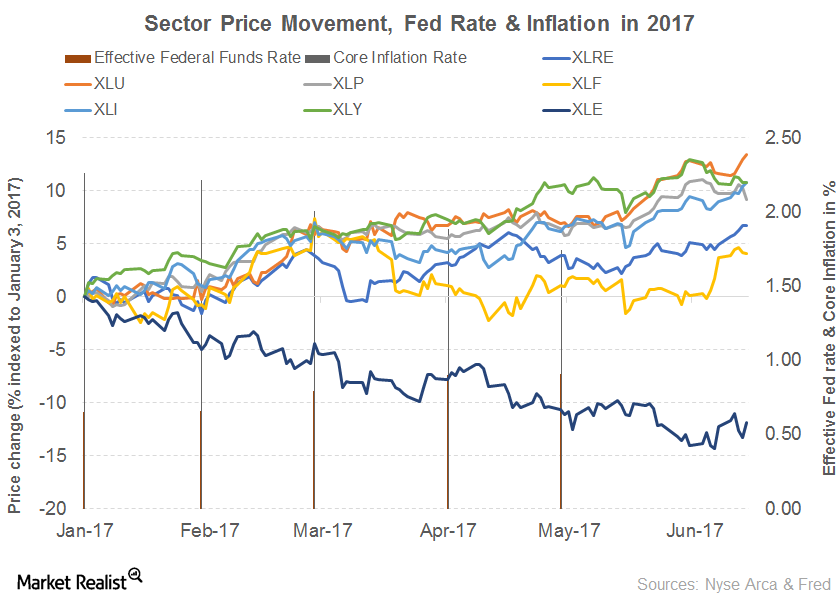

Comparing Growth and Value Stock Sectors

The SPDR S&P 500 Growth ETF (SPYG) has generated a YTD return of 13.3% versus 4.3% from the SPDR S&P 500 Value ETF (SPYV).