A Glance at Future Prospects for the Crude Oil Market

ETF Securities Outlook: Crude Oil OPEC’s decision to extend its production cuts through March 2018 was met with disappointment in markets. While this is a positive sign for the global crude market which continues to rebalance from a multi-year supply glut, expectations of continued US productions will remain in focus. There have been encouraging signs […]

Nov. 20 2020, Updated 11:30 a.m. ET

ETF Securities

Outlook: Crude Oil

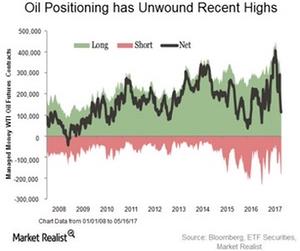

OPEC’s decision to extend its production cuts through March 2018 was met with disappointment in markets. While this is a positive sign for the global crude market which continues to rebalance from a multi-year supply glut, expectations of continued US productions will remain in focus. There have been encouraging signs in recent weeks of US inventory drawdowns which if sustained could support current price levels. Additionally, OPEC has had a poor track record in keeping compliance to its stated quotas. Lack of follow through on this extended deal by OPEC members may weigh negatively on prices. With continued tightening fundamentals and reduced investor sentiment (see “Oil positioning has unwound recent highs” chart below), we expect prices to range from $40-55/barrel this year.

Market Realist

Crude oil market future prospects

The recent extension of production cuts by OPEC (Organization of the Petroleum Exporting Countries) was a disappointment. Many investors expected a deeper cut that would control excess supply and cause oil prices to bounce back and drive energy returns (XLE). The primary strategy of OPEC’s production cuts was to contain excess crude oil production and ultimately lift prices.

As we saw in Part 2 of this series, increasing US crude oil production contributed to the bearishness in WTI crude oil prices. Data from the EIA (U.S. Energy Information Administration) forecast that US crude oil production could reach 9.3 million barrels per day in 2017 and 10.0 million barrels per day in 2018 on average, or rises of 4.0% and 12.0%, respectively, from 2016 production levels. That would be negative for crude oil prices.

In a Deloitte research paper, John England, vice chair and US Energy & Resources leader and US and Americas Oil & Gas leader at Deloitte, expressed optimism about the supply and demand of crude oil to be in equilibrium in 2017.

The EIA’s forecast for WTI crude oil prices for 2017 is $51 per barrel, which is lower than the earlier estimate of $55 per barrel, but higher than we are now. The fall in oil prices hampers the earnings of various oil producers such as Carrizo Oil & Gas (CRZO), Denbury Resources (DNR), and Murphy Oil (MUR), which drives down the energy sector’s returns.

However, (BEF) can give investors that are looking for a move higher in energy prices a vehicle that will not only move up with energy prices but provides a damper to volatility given the 3-month schedule. Not only that but (BEF) is also comprised of both oil and natural gas, diversifying energy returns, while remaining low cost and K-1 free.

In addition to the fundamental traditional drivers of energy (IXE) returns, there are various other factors that influence oil prices and affect the energy sector, which include geopolitical and economic events, global economic growth, non-OPEC production, and unplanned supply disruptions.