Maxwell Gold

Disclosure: The content Market Realist publishes should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of ETF Securities.

More From Maxwell Gold

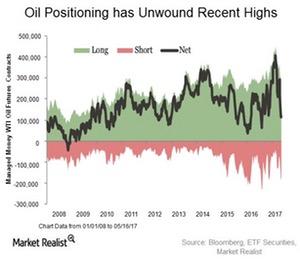

A Glance at Future Prospects for the Crude Oil Market

ETF Securities Outlook: Crude Oil OPEC’s decision to extend its production cuts through March 2018 was met with disappointment in markets. While this is a positive sign for the global crude market which continues to rebalance from a multi-year supply glut, expectations of continued US productions will remain in focus. There have been encouraging signs […]

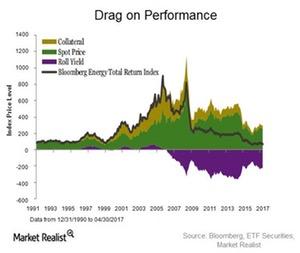

Can Backwardation Drive Energy Returns?

ETF Securities A return to backwardation? Among the three components of total return when investing in futures contracts (price return, roll yield, and collateral yield), the roll yield for the energy sector has been a continuous performance drag over the last decade (see “Drag on performance” chart below). Oil futures markets are most often in […]