Can the Rebound in Chinese Steel Prices Support Iron Ore Miners?

One of the major factors that led to the iron ore price rally in 2016 and 1Q17 was stronger-than-expected Chinese steel prices.

July 3 2017, Updated 10:37 a.m. ET

China’s steel prices

One of the major factors that led to the iron ore price rally in 2016 and 1Q17 was stronger-than-expected Chinese steel prices. High steel prices provided an incentive for steel mills to produce higher volumes, which means higher raw materials, including iron ore.

2Q17 hasn’t been kind to iron ore prices as steel prices started to give way on concerns of a demand slowdown in China. In this article, we’ll see how steel prices are progressing and what the outlook is like.

Prices trending higher

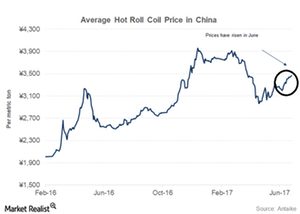

The recent news from the Chinese government about enforcing steel capacity cuts bodes well for Chinese steel prices. According to data compiled by Antaike, benchmark hot-rolled coil prices have risen almost 6.0% so far in June and are currently at a three-month high. This rise has more to do with supply-side changes than any improvement in domestic demand.

Impact on mining companies

Since Chinese steel prices aren’t supported by strong domestic demand currently, the current rally might fade away as steel capacity cuts complete. Since seaborne iron ore prices take a cue from steel prices, they also might be in for a rough ride until demand improves or supply subsides. This development would, in turn, be a negative for seaborne suppliers (PICK) such as Rio Tinto (RIO), BHP (BHP) (BBL), Vale (VALE), and Cliffs Natural Resources (CLF).