Why Bond Yields Were Unaffected by Trump News

US Treasuries (SCHO) rallied all through the previous week supported by heavy safe-haven inflows into US bonds.

May 22 2017, Published 3:23 p.m. ET

Uncertainty aids demand for bonds

US Treasuries (SCHO) rallied all through the previous week supported by heavy safe-haven inflows into US bonds. In times of uncertainty, investors turn to US Treasuries (IEI), as these bonds are safe-haven assets that are highly unlikely to lose value in times of uncertainty. In such situations, the bond prices increase and the bond yields (BND), which are the implied returns on investment, decrease.

The US ten-year bonds (IEF) closed for the week at 126.19 as compared to 125.47 in the previous week. The ten-year yield, on the other hand, drifted lower to 2.24% from 2.34%. The two-year bond yields (SHY) moved lower by three basis points to 1.27% as compared to 1.30% in the previous week.

Bond traders continue with bullish bets

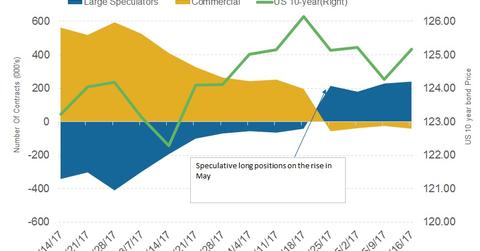

As per the latest CFTC reports, large speculators have increased their net positions and continue to remain bullish. The total net position stood at 240,010 contracts, an increase of 10,891 contracts, which suggests the highest level of optimism from bond traders in the last ten years. However, investors should watch this space carefully. If the Fed continues with its rate hikes, bond prices are likely to come down, but traders are betting on the contrary. Only time will tell if these speculative bets pay off.

Key movers for bond yields this week

This week, comments from Fed members in regards to a rate hike in June could impact the bond markets. Along with these speakers, the FOMC meeting minutes from the May meeting will also be a key focus, as investors will look at them to gauge the chances of a rate hike in June.