PVH Stock Rises 5% following Its 1Q17 Results

PVH Corporation (PVH) reported a strong 1Q17 on May 24, 2017, beating analysts’ consensus estimate on both its top and bottom lines.

May 29 2017, Updated 10:37 a.m. ET

PVH Corporation is among the best apparel stocks

As discussed, PVH Corporation (PVH) reported a strong 1Q17 on May 24, 2017, beating analysts’ consensus estimate on both its top and bottom lines. The company’s stock rose 4.9% to close at $106.98 on May 25.

PVH is now sitting at year-to-date (or YTD) rise of 19%, outperforming most other apparel players and the S&P 500 Index (SPX) with its rise of 7%. Competitors Ralph Lauren (RL), Lululemon Athletica (LULU), and Under Armour (UAA) have fallen 26%, 25%, and 32%, respectively, YTD.

PVH has also outperformed the S&P 500 Apparel and Accessories Index, which has fallen 3% YTD. The index tracks Ralph Lauren, Hanesbrands (HBI), VF Corporation (VFC), Coach (COH), PVH, Michael Kors (KORS), and Under Armour. Among the above-mentioned companies, only Coach has done better than PVH with a return of 31%.

Recent analyst action on PVH

After PVH’s expectation-beating results, the company was upgraded by JPMorgan to “overweight.” PVH is a “rarity in retail,” according to JPMorgan Chase analyst Matt Boss. Boss increased the stock’s target price to $125.00 from $116.00.

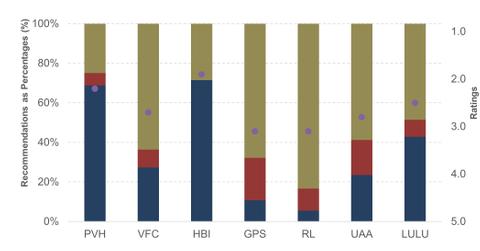

The company has earned “buy” ratings from 69% of the 16 analysts that cover it. This is one of the highest “buy” percentages in the apparel retail segment. VF Corporation and Ralph Lauren, in comparison, have ~27% and 6% “buy” ratings, respectively. Only HBI, with “buy” recommendations from 71% of analysts, is in a better position.

PVH has received a 2.2 rating from analysts on a scale of 1 (strong buy) to 5 (strong sell). This rating is better than the ratings of VF Corporation, Ralph Lauren, and The Gap, which have ratings of 2.7, 3.1, and a 3.1, respectively.

ETF investors seeking to add exposure to PVH can consider the PowerShares S S&P 500 High Beta ETF (SPHB), which invests ~1% of its portfolio in PVH.