PowerShares S&P 500 High Beta ETF

Latest PowerShares S&P 500 High Beta ETF News and Updates

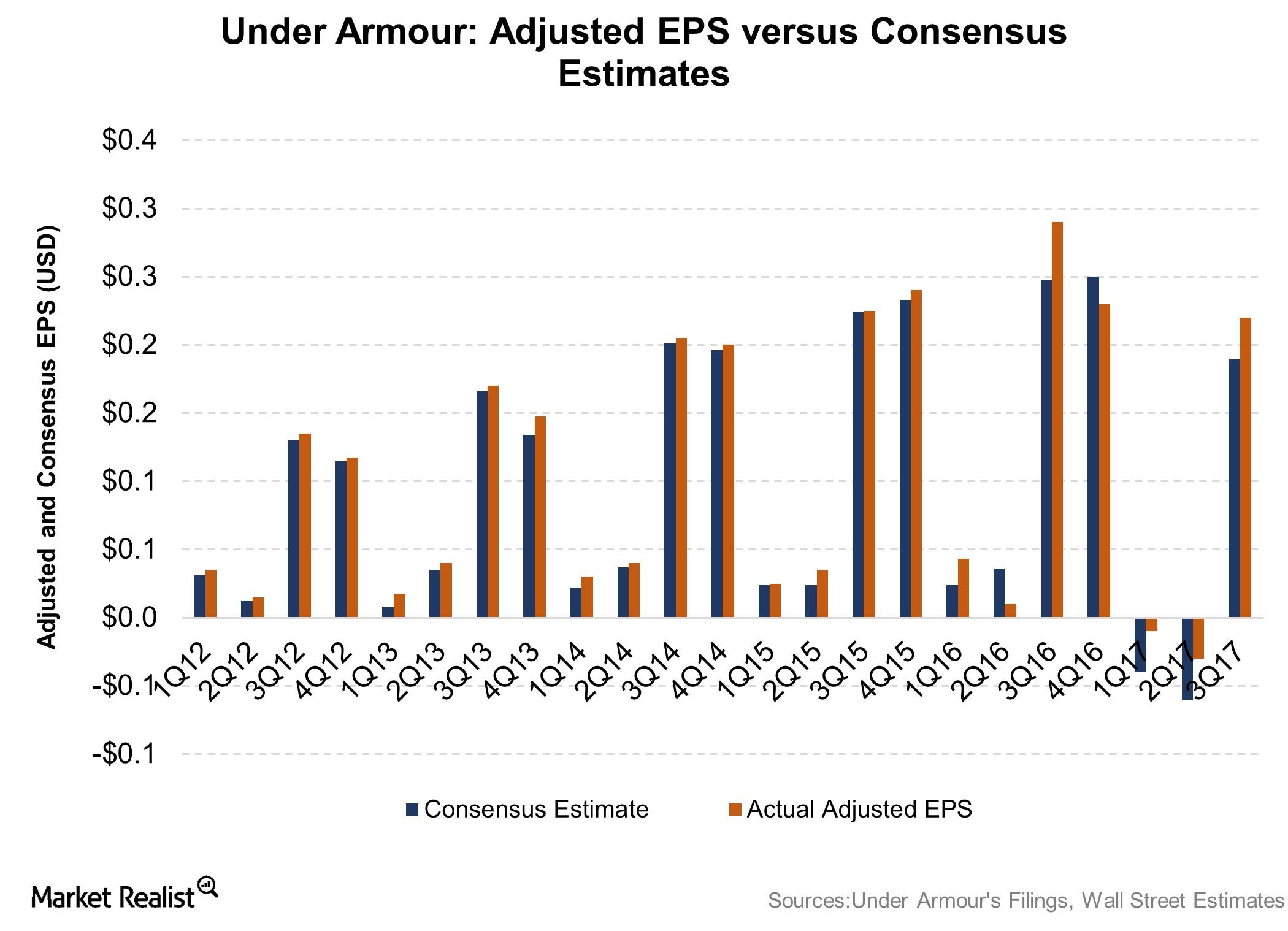

Under Armour Beats Earnings per Share Estimate by $0.03

Baltimore-based Under Armour (UAA) reported its 3Q17 results on October 31.

Under Armour Faces Target Price Cuts

Wall Street’s reaction to 2Q17 earnings Under Armour’s (UAA) 2Q17 results were followed by a host of analyst actions, ranging from target price cuts to downward revisions. The stock’s target price was revised by UBS (from $21 to $19), Canaccord Genuity (from $21 to $18), Stifel (from $19 to $18), Wedbush (from $18 to $17), […]

Under Armour Beats Top- and Bottom-Line Expectations

Baltimore-based Under Armour (UAA) reported its 2Q17 results on Tuesday, August 1. This series is an overview of Under Armour’s 2Q17 results.

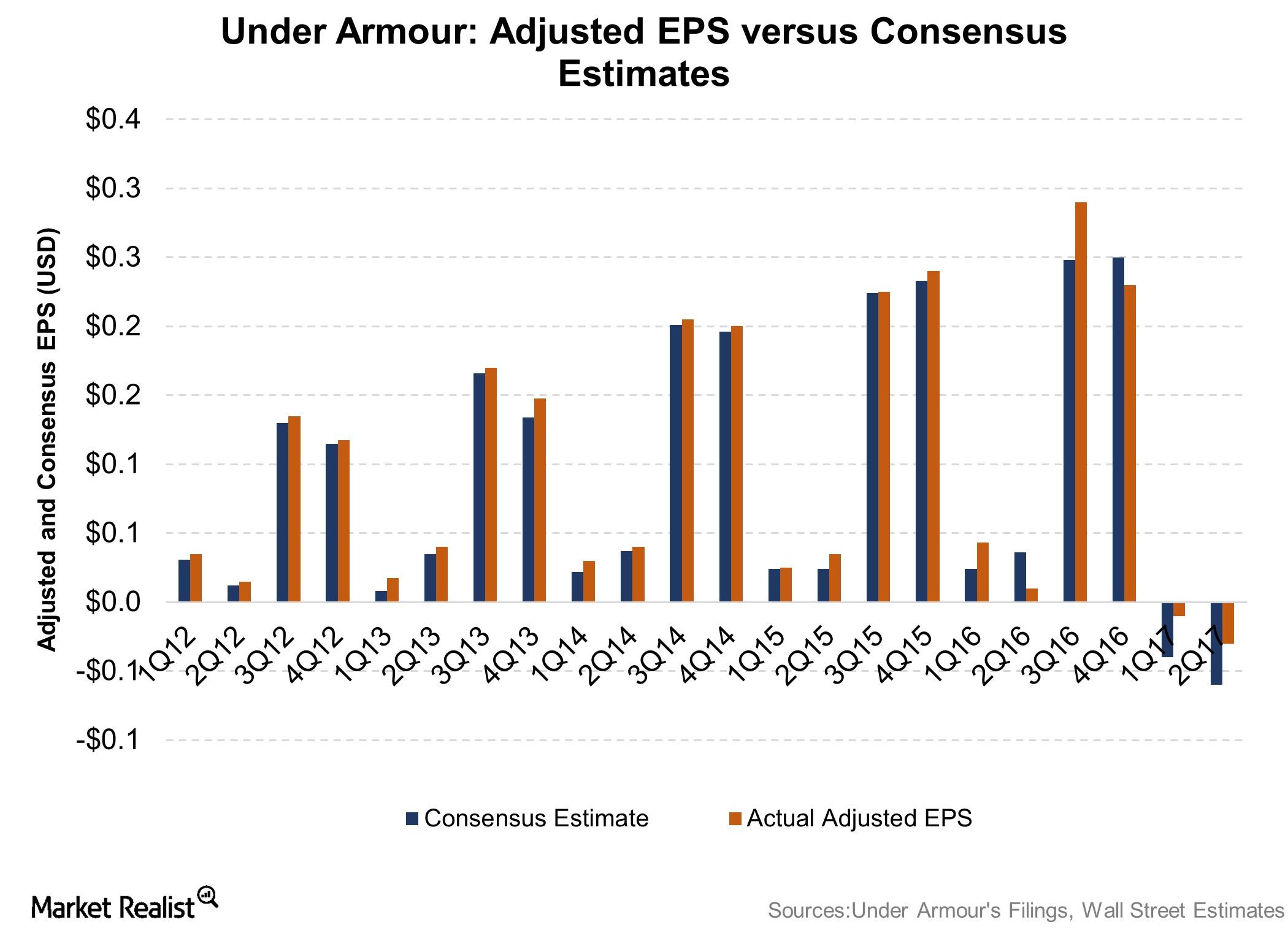

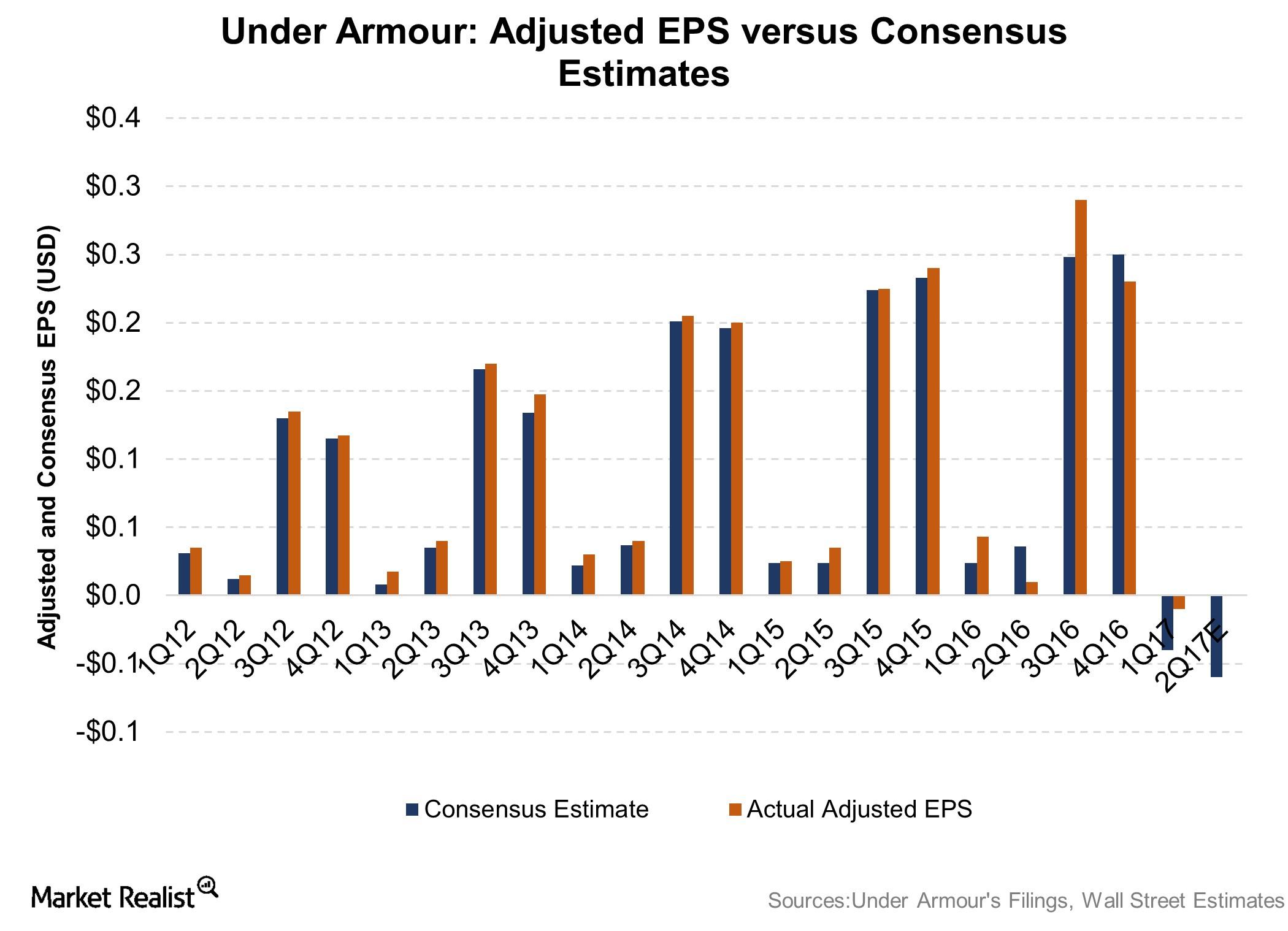

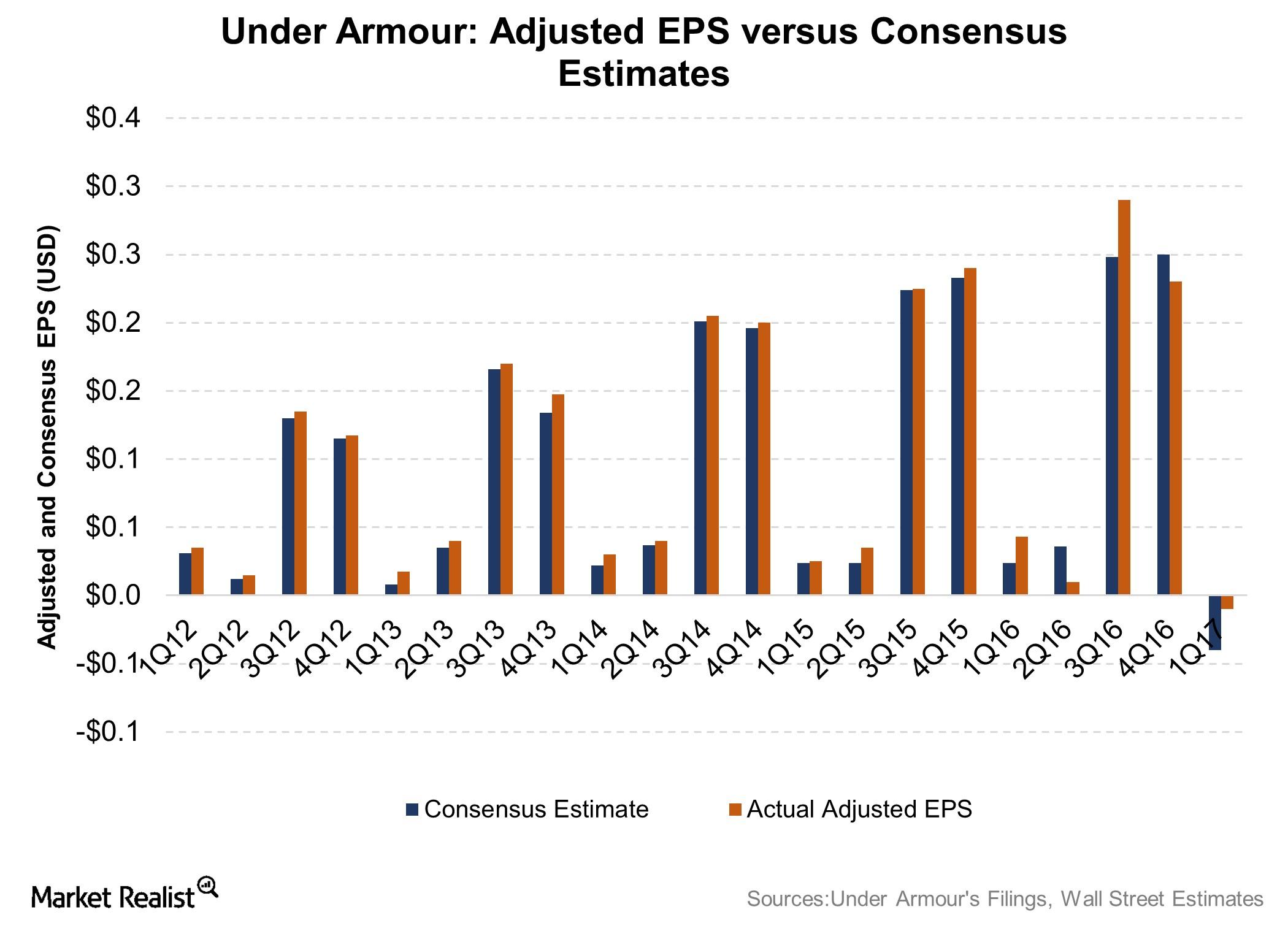

Under Armour Reports a Loss Once Again in 2Q17

A look at Under Armour’s 2Q17 bottom line Under Armour (UAA), which released its 2Q17 results on August 1, reported net earnings of -$12 million, or EPS (earnings per share) of -$0.03. The company reported a weaker gross margin and a rise in SG&A (selling, general, and administrative) expenses. In comparison, it reported earnings of $19 […]

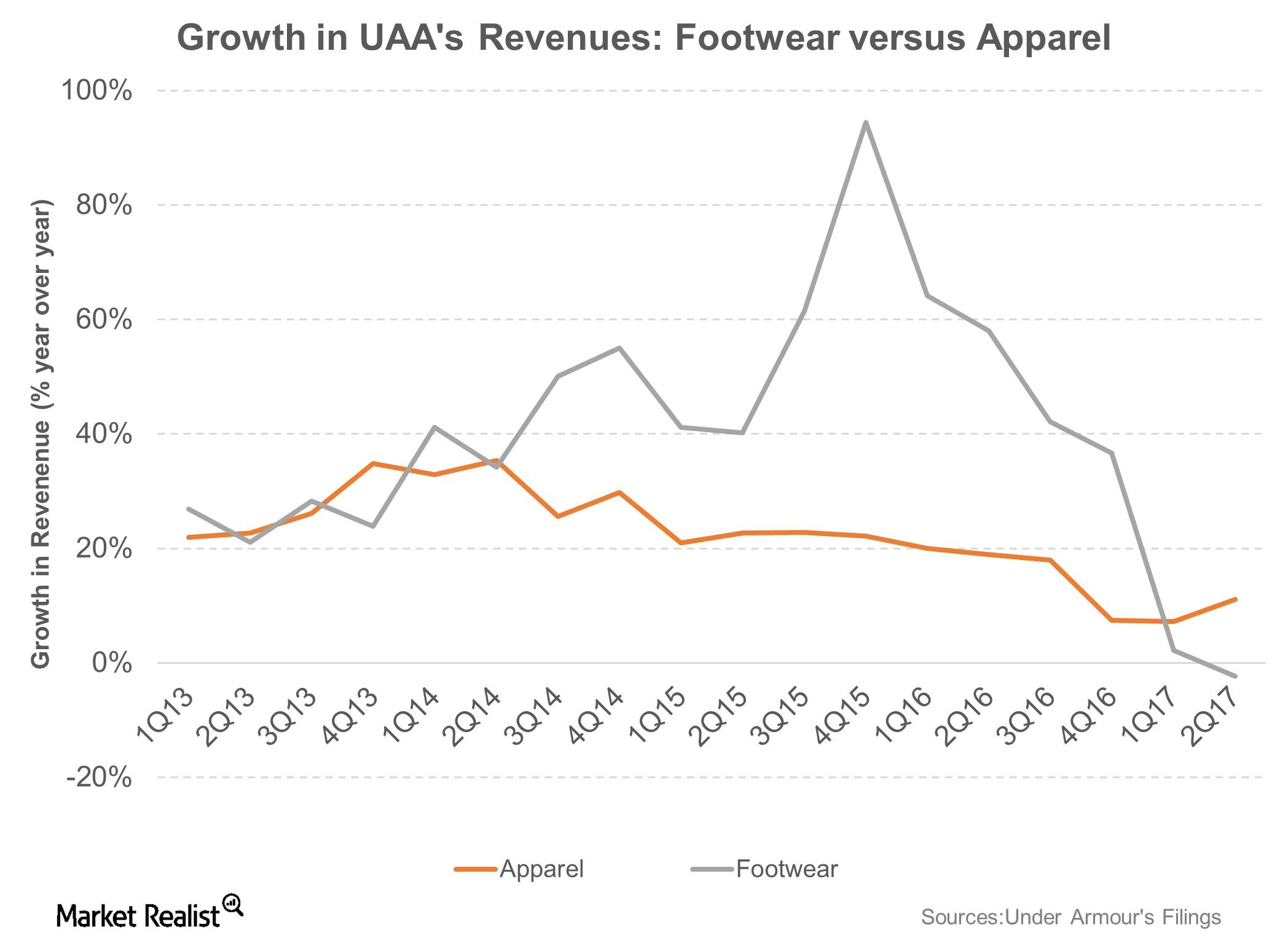

Under Armour’s 2Q17 Footwear Sales Lose Traction

Footwear growth turns negative Under Armour’s (UAA) footwear business was considered the company’s growth engine until recently. The company recorded average quarterly growth of 52% between fiscal 2014 and 2016. However, 2Q17 was a complete letdown. Sales were down 2% YoY (year-over-year) as the company coped with tough comparisons with the year prior. Also impacting sales […]

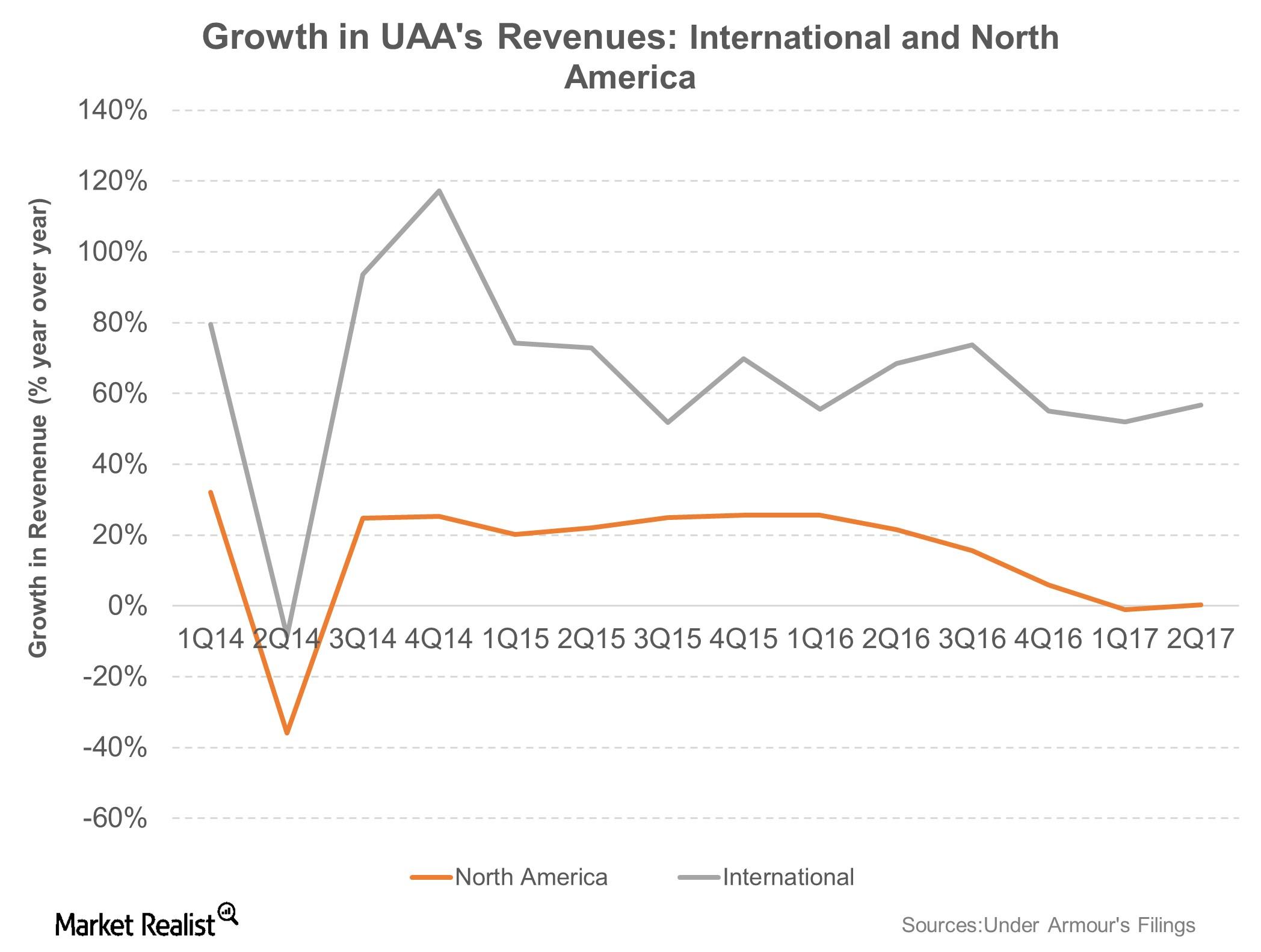

Weak North American Sales Force Under Armour to Revise Outlook

Under Armour revises guidance As discussed in the previous section, Under Armour’s (UAA) top line grew 8.6% YoY (year-over-year) in 2Q17, against the average growth of 20% it saw up until 3Q16. This slowdown was primarily anchored by weakness in its North American business, which grew by just 0.3% during the quarter. The wholesale business was […]

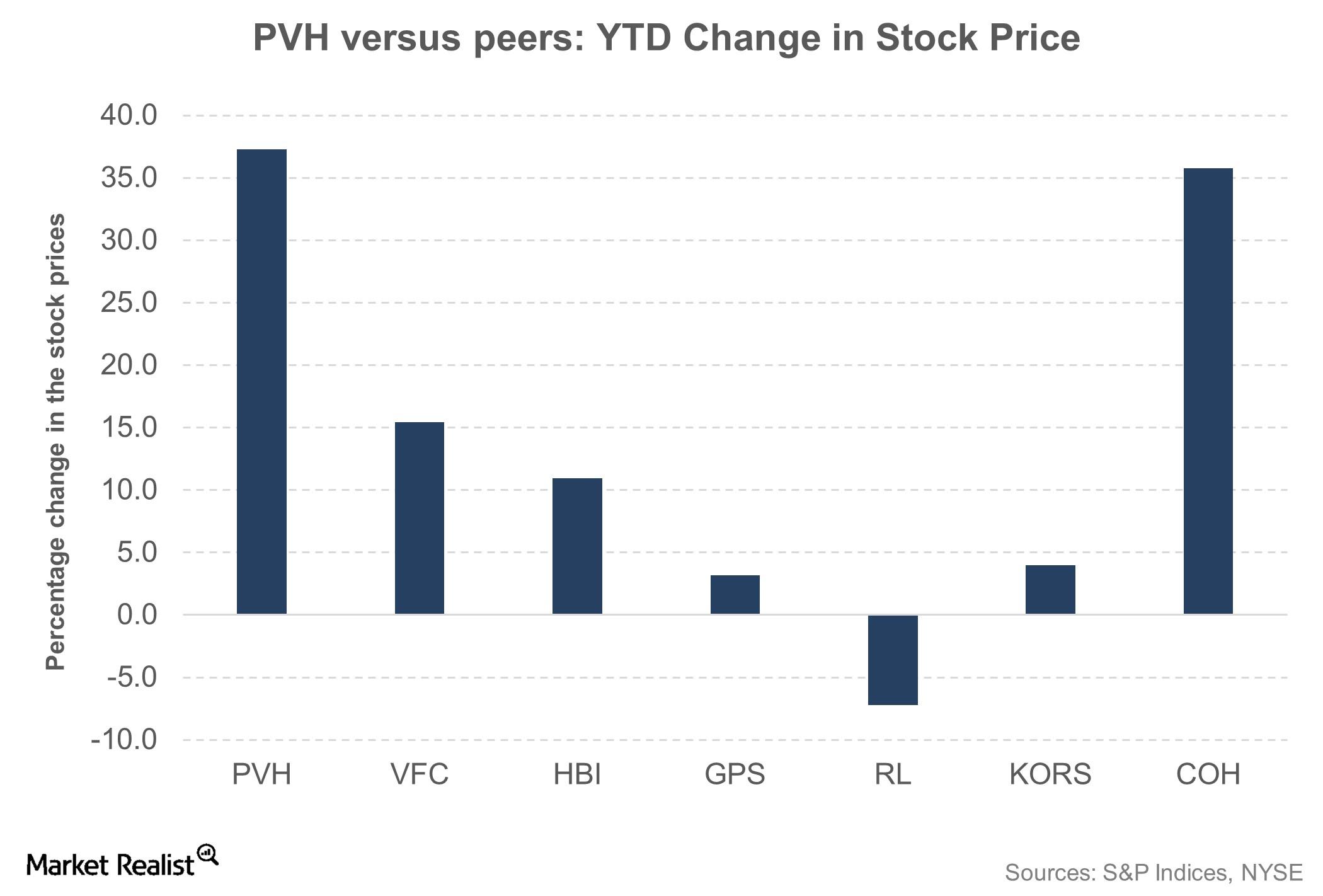

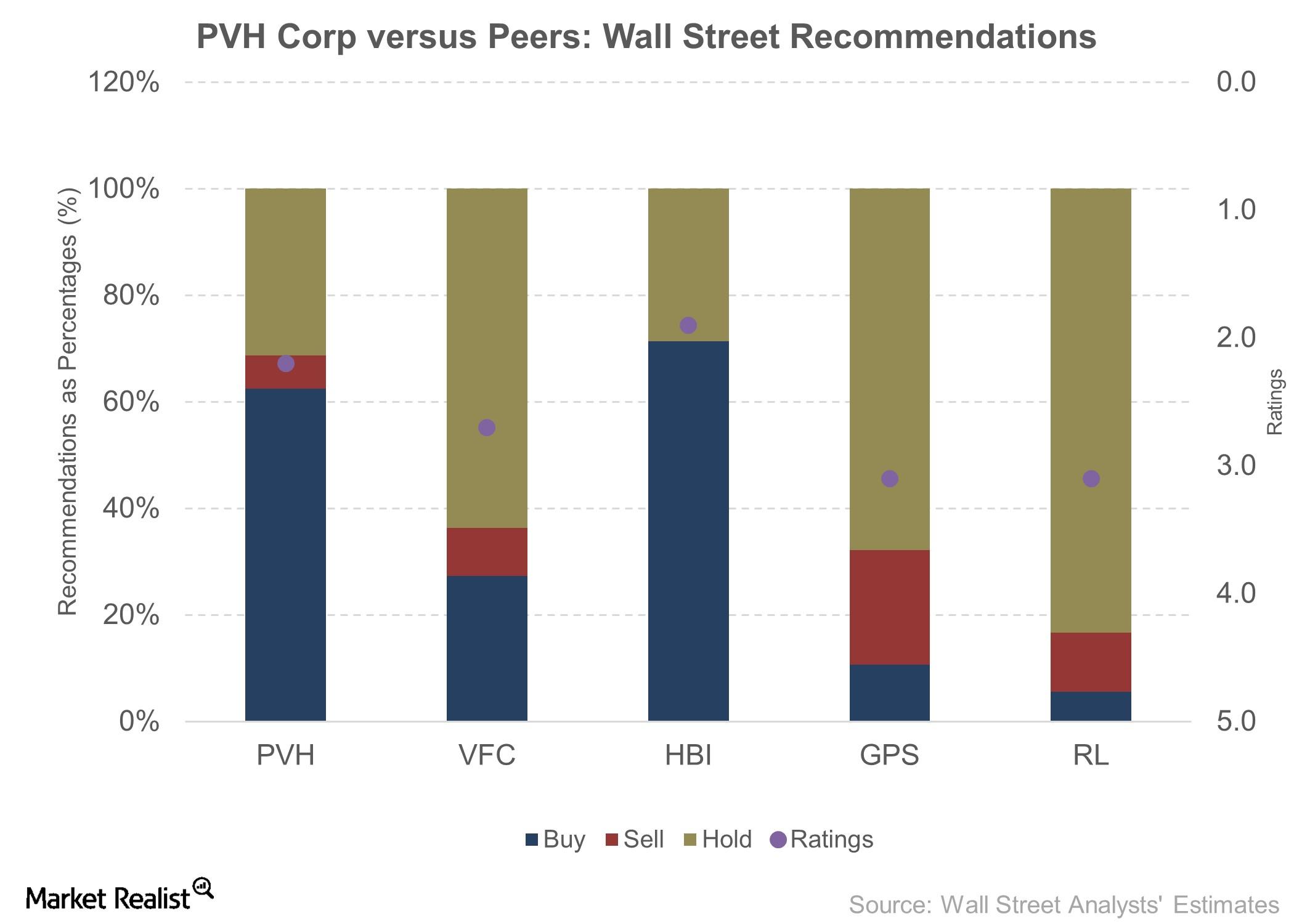

What Wall Street Thinks of PVH Corp Now

PVH’s YTD gains have outperformed Hanesbrands’ (HBI) 11%, VF Corporation’s (VFC) 15.5%, Michael Kors’s (KORS) 4%, and Ralph Lauren’s (RL) -7.2% gains.

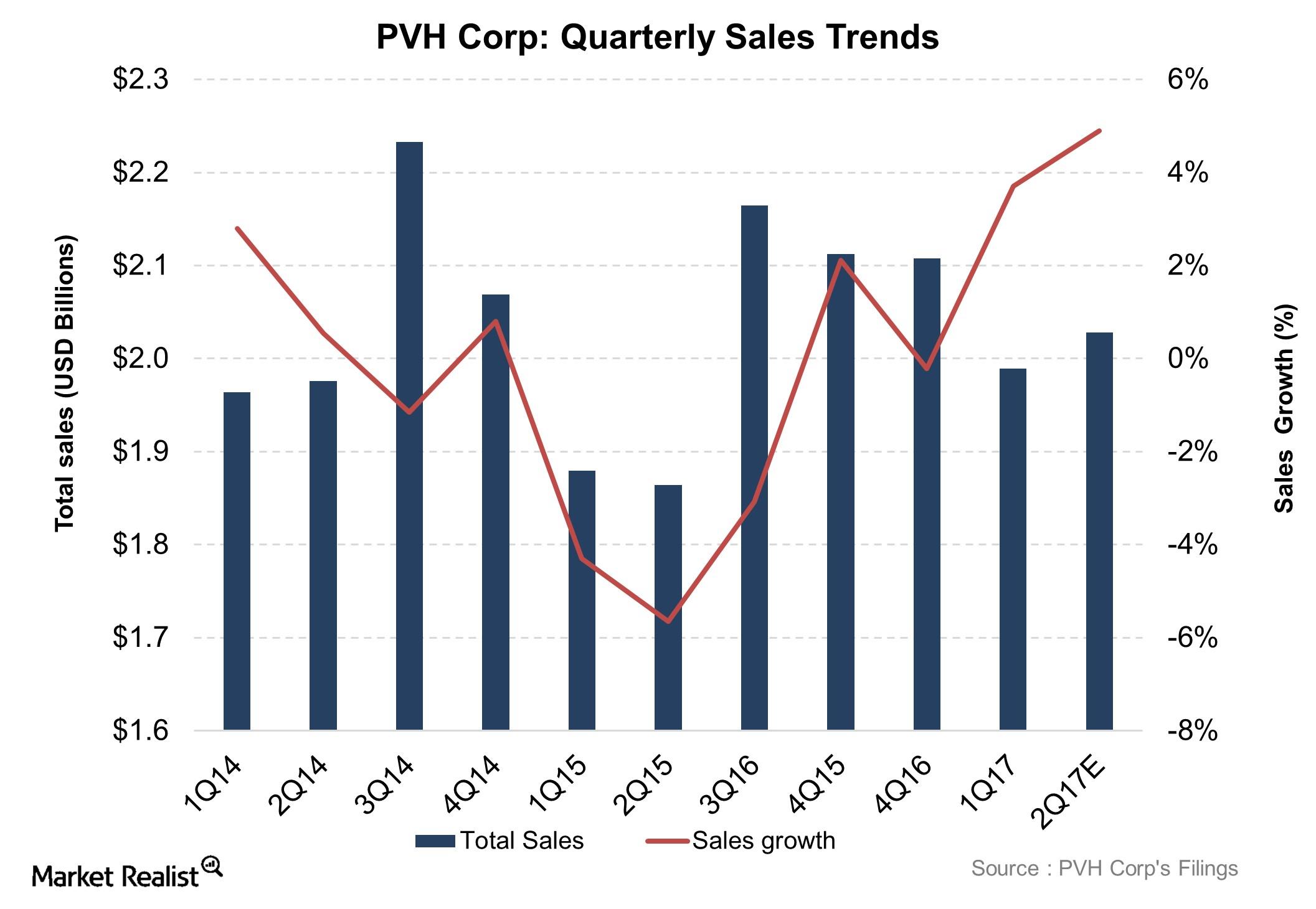

Despite Currency Headwinds, PVH Delivers Better Growth than Peers

PVH Corporation’s (PVH) top line is predicted to grow 4.9% YoY (year-over-year) in 2Q17.

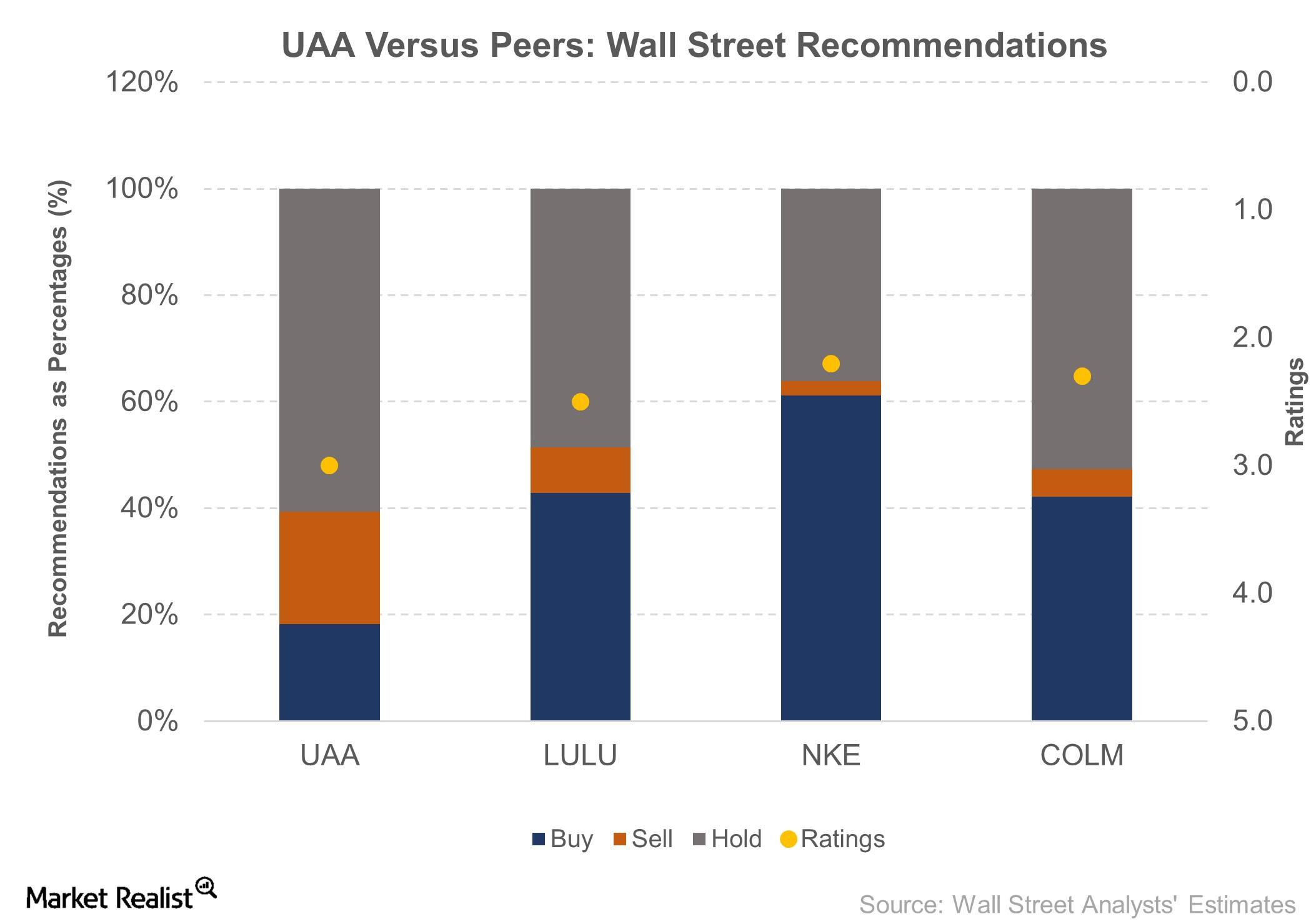

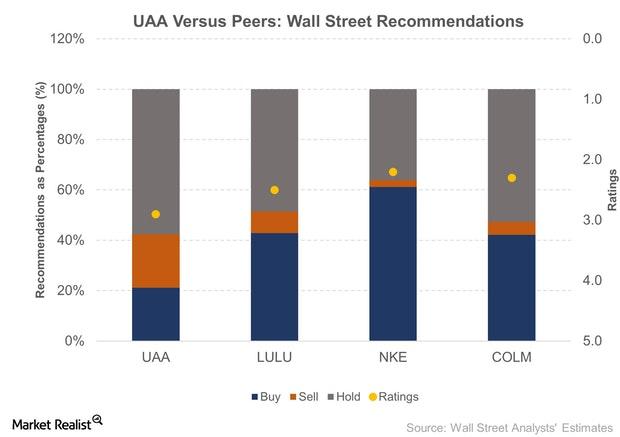

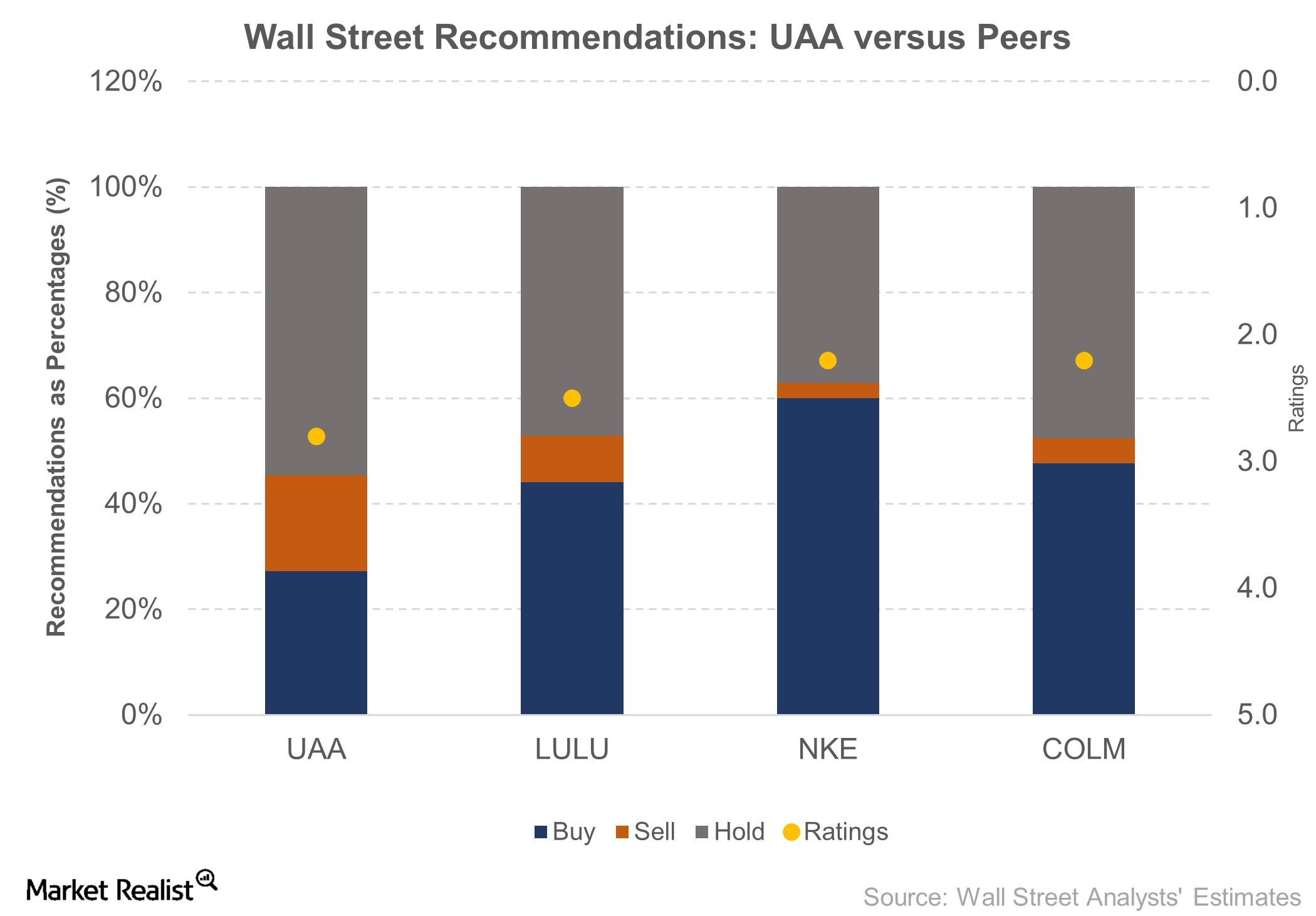

What Wall Street Thinks of Under Armour

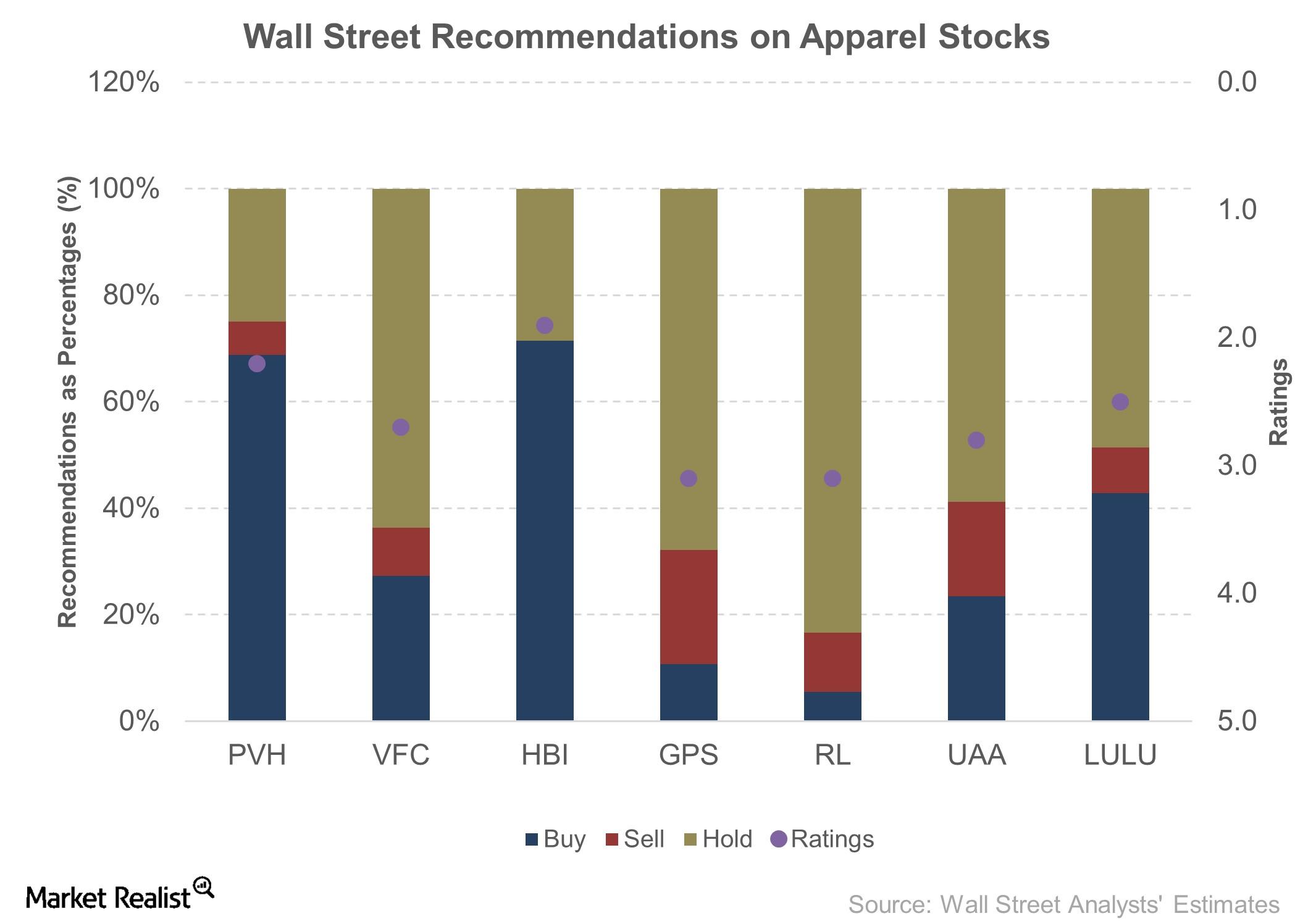

Under Armour has a 2.8 rating on a scale where one is a “strong buy” and five is a “strong sell.”

Operating Loss Could Be in the Cards for Under Armour in 2Q17

Under Armour is expected to report a loss of six cents per share in 2Q17, which follows a loss per share of one cent during the first quarter.

Under Armour’s 2Q17 Earnings: What to Expect

Under Armour (UAA) is expected to report results for 2Q17 on Tuesday, August 1, 2017.

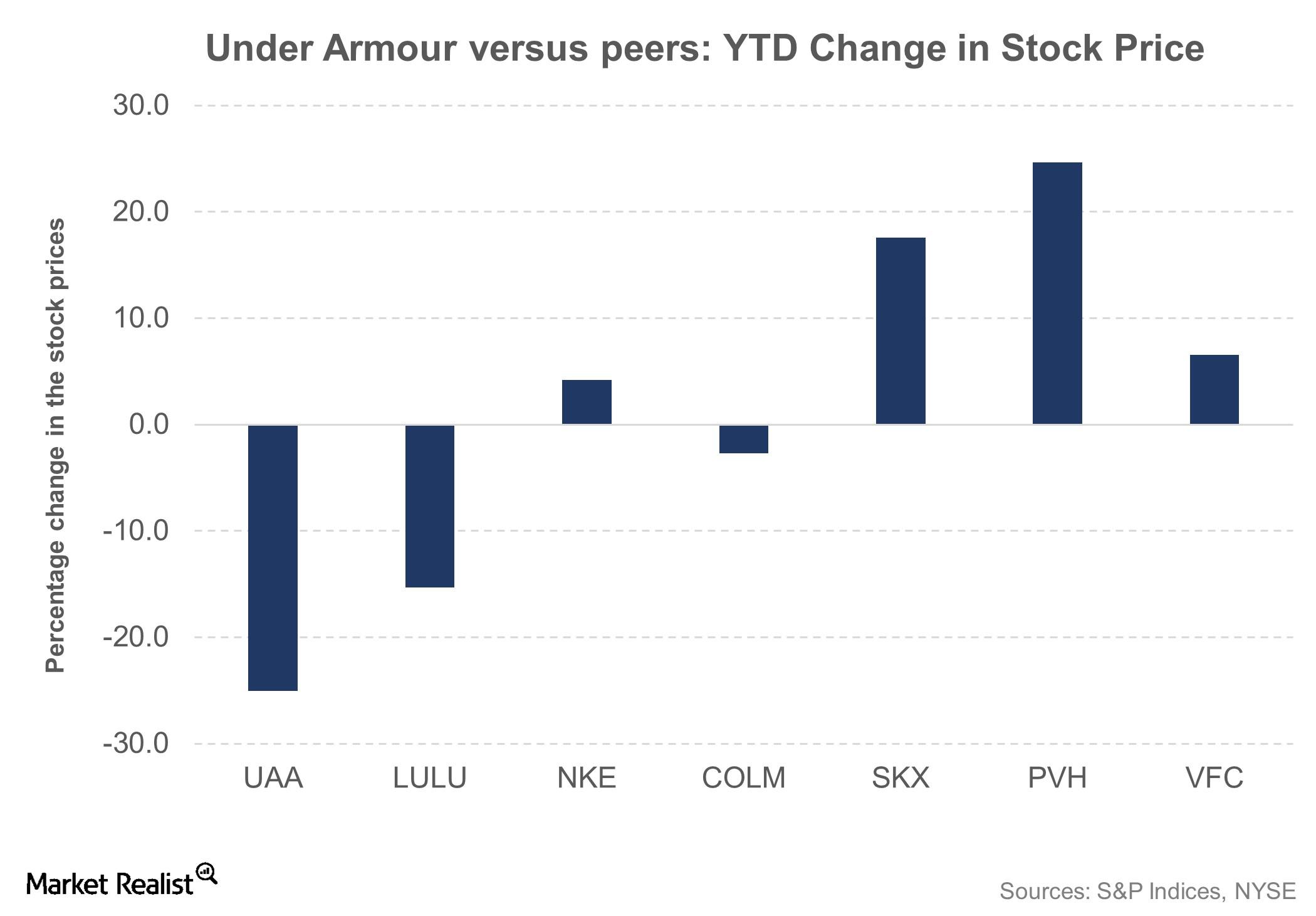

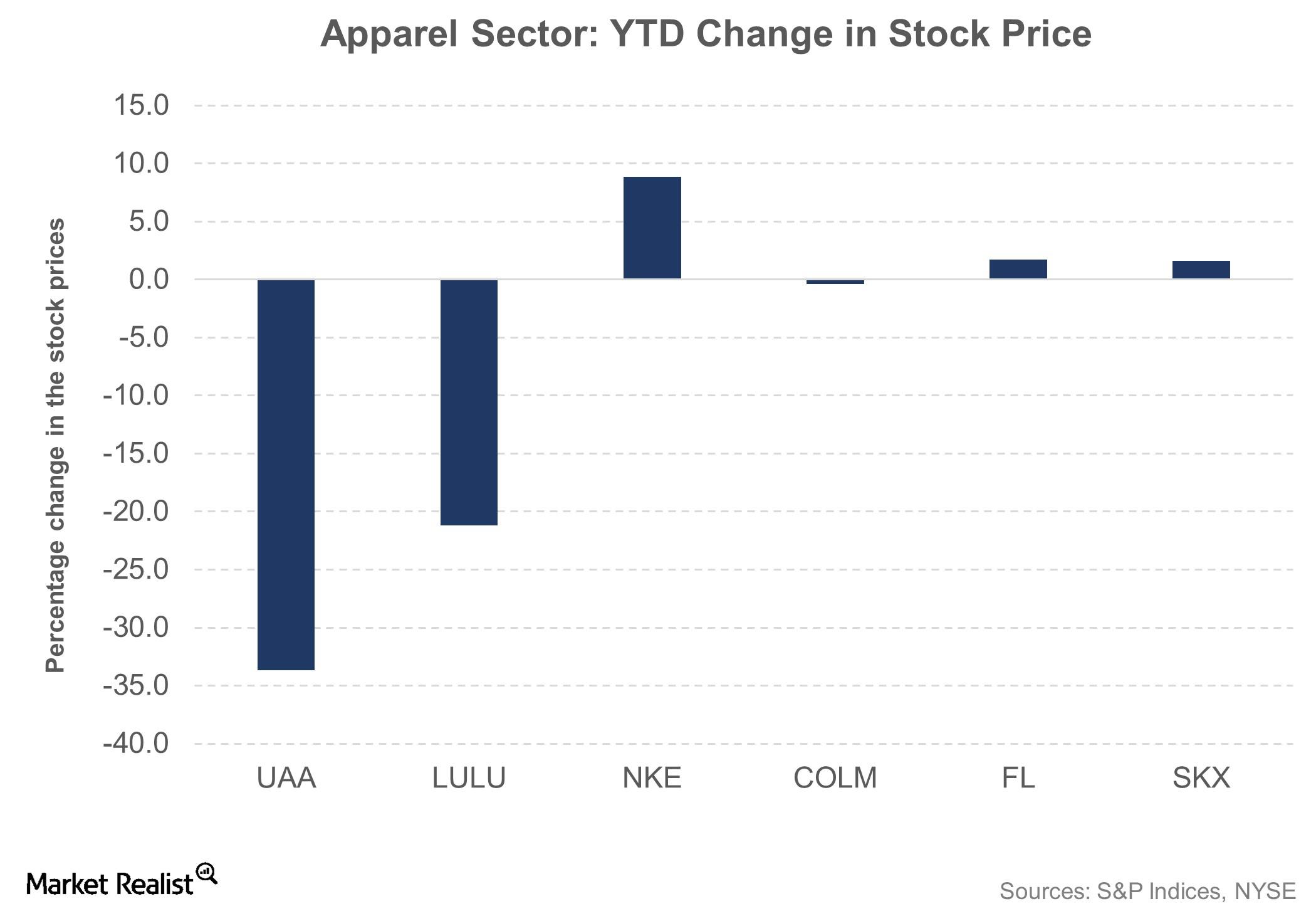

Under Armour Trading 40% Lower Than a Year Ago

Under Armour (UAA) stock remained unfazed after the company announced its new senior level executives, rising ~1.0% and closing at $25.06.

PVH Stock Rises 5% following Its 1Q17 Results

PVH Corporation (PVH) reported a strong 1Q17 on May 24, 2017, beating analysts’ consensus estimate on both its top and bottom lines.

PVH Raises Its Earnings Guidance after Robust 1Q17 Results

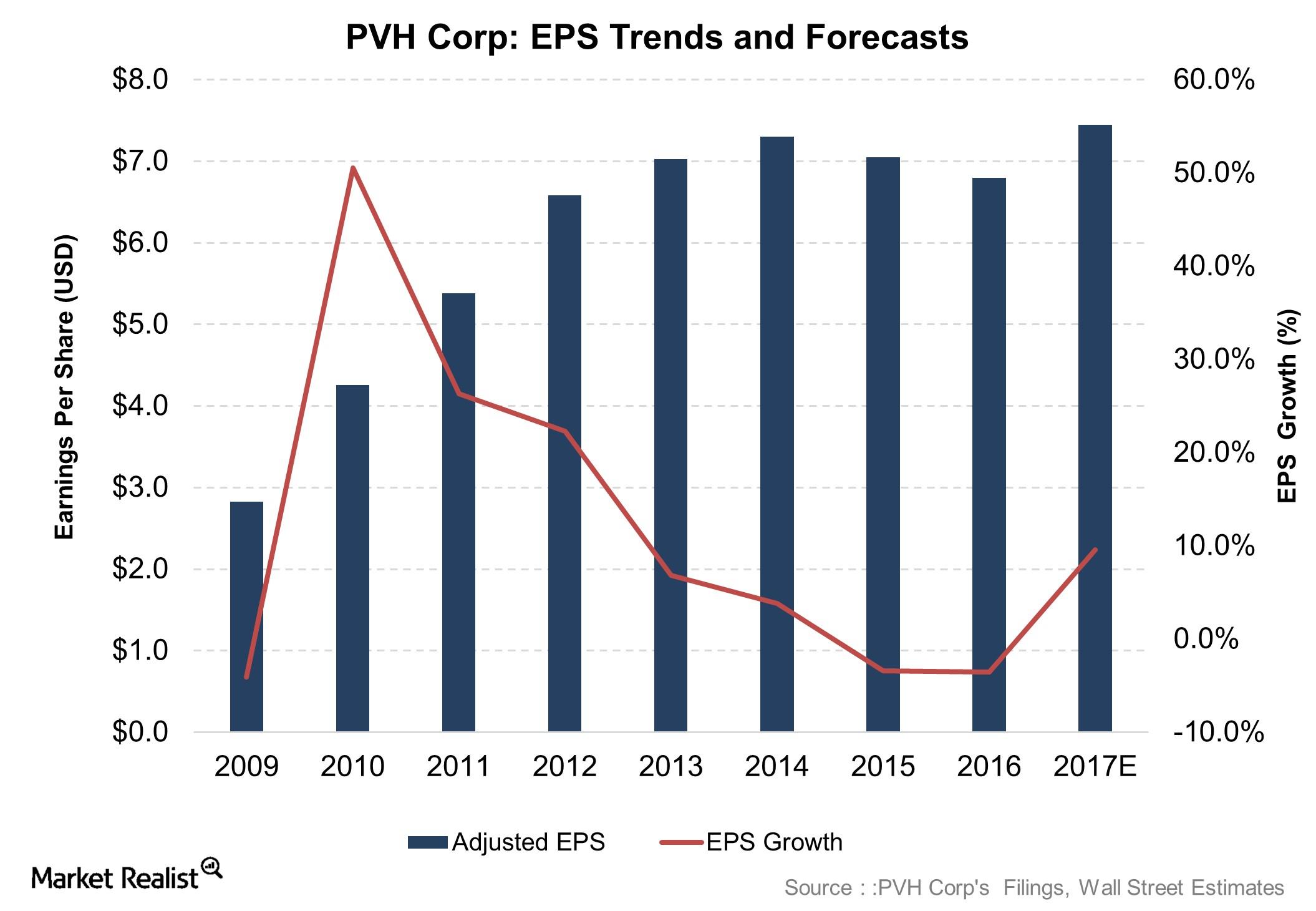

PVH Corporation (PVH), which reported its 1Q17 results on May 24, 2017, saw its earnings rise 10% YoY (year-over-year) to $1.65 per share.

Wall Street Analysts’ View on PVH Corp Is Positive

PVH Corp stock is covered by 16 analysts—63% of the analysts recommended a “buy,” 31% recommended a “hold,” and 6% recommended a “sell.”

Under Armour’s Stock Surges after 1Q17 Earnings

Under Armour’s (UAA) stock rose 10% as the company reported better-than-expected 1Q17 top and bottom lines and maintained its fiscal 2017 guidance.

Under Armour Beats 1Q17 Earnings and Revenue

The Baltimore-based Under Armour (UAA) reported its results for 1Q17 on Thursday, April 27. Here’s what you need to know.

Behind Under Armour’s Poor Stock Performance

Under Armour (UAA) was among the worst performers on the S&P 500 Index (SPY) in 2016, losing 30% of its value during the year.

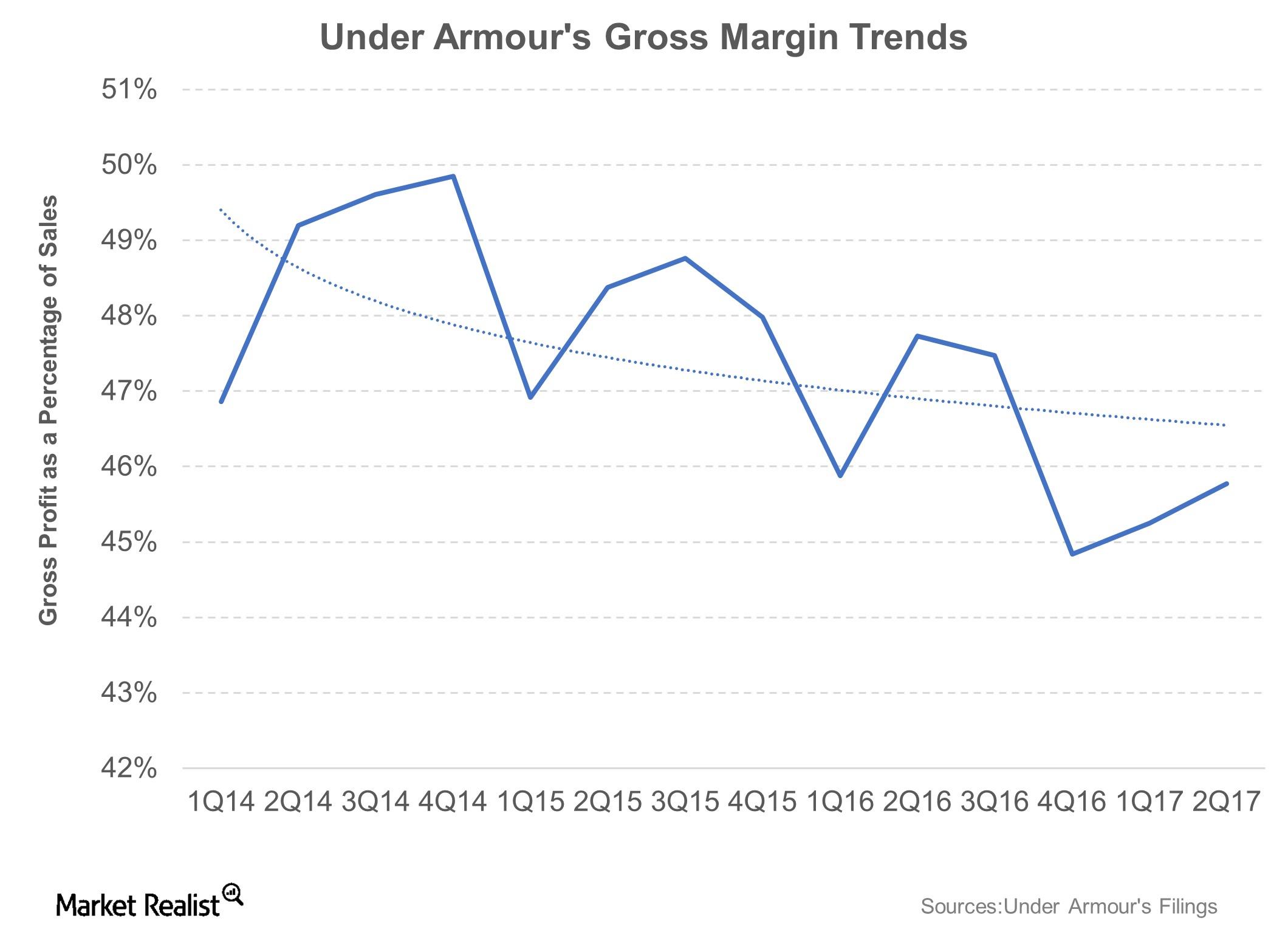

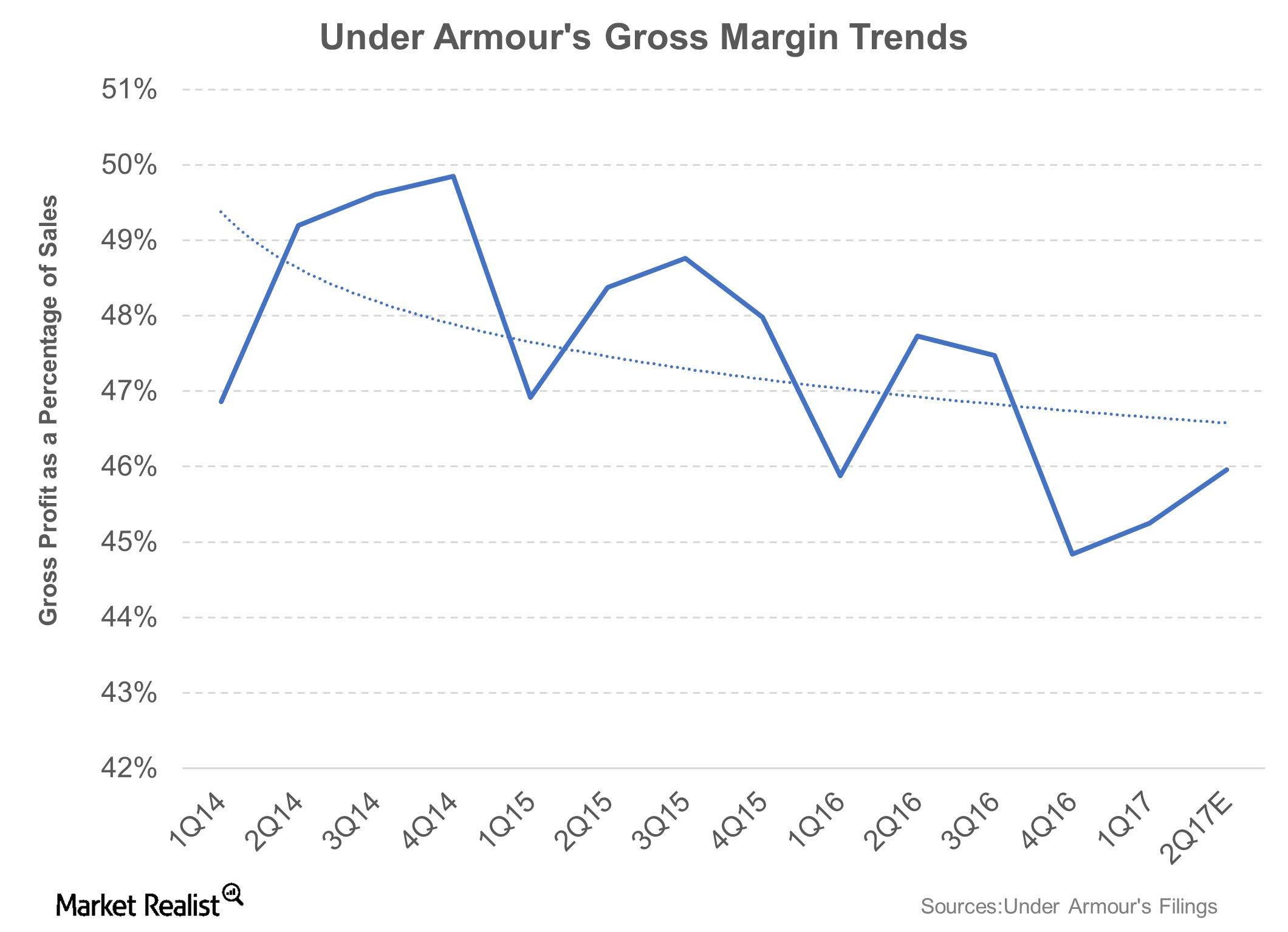

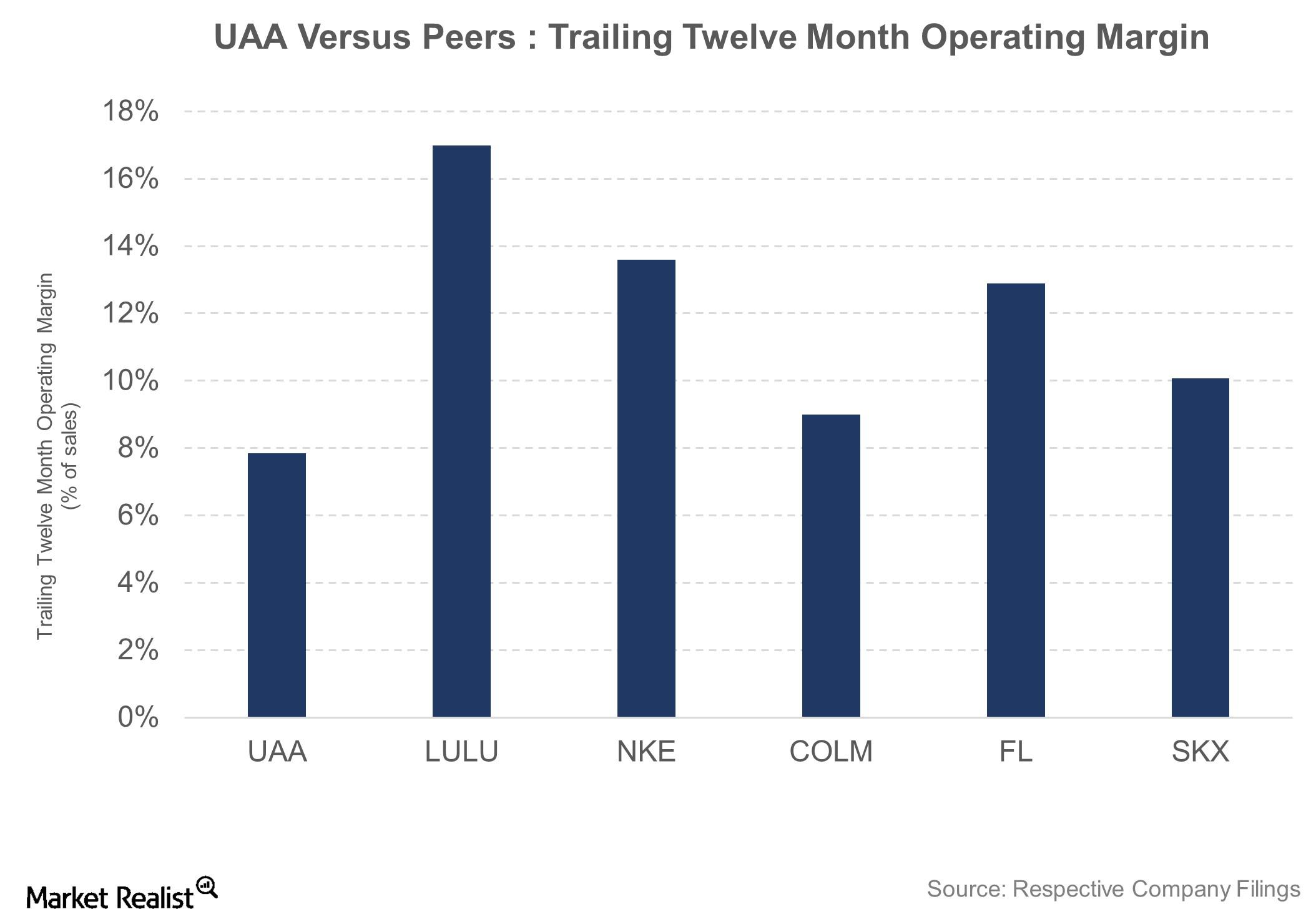

Underneath Under Armour’s Compressed Margins

Under Armour’s (UAA) gross margin fell 160 basis points to 46.5% in fiscal 2016, and its gross margin took the worst hit in the fourth quarter of 2016.