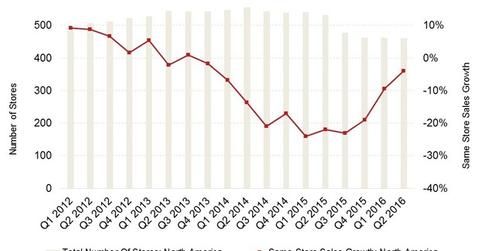

Can Coach Revive North America Same-Store Sales in Fiscal 2016?

Coach’s (COH) performance in North America remained pressured in the quarter, with sales declining 7% in reported terms to $731 million.

Nov. 22 2019, Updated 7:23 a.m. ET

Analyzing Coach’s performance in North America

Coach’s (COH) performance in North America remained pressured in the quarter, with sales declining 7% in reported terms to $731 million. Sales declined by 6% in constant-currency terms. Revenue declined in both the retail (XRT) and wholesale channels. Retail sales declined partly as a result of store closures (three in the quarter) and partly due to lower traffic. The wholesale channel was also hurt by softness in department store sales. Sales at department stores declined at a mid-single-digit rate. North America sales also felt the impact of lower tourist traffic, partly as a result of the higher US dollar and partly as a result of lower outbound traffic from China.

Same-store sales

Despite the closures, same-store sales in North America declined by 4%. Coach’s figures were also negatively impacted by a lower number of sales events, which hurt its North America performance. As part of its stated goals, Coach has progressively cut down on promotional events, in an effort to boost sales and maintain brand value. A reduction in eOutlet sales reduced comps by one percentage point.

Market trends

Transaction growth for the women’s accessories category in the United States has been weak for several quarters now at point of sale.[1. Source: First Data] In calendar 4Q15, despite growth in ticket size, dollar value sales declined due to the lower number of transactions stemming from lower foot traffic to brick-and-mortar locations.

Coach’s results have reflected this trend. Sales of higher-priced handbags have been accounting for a larger percentage of the sales mix for several quarters now. The company is also seeing lower demand for logo bags. A shift toward premium pricing has been part of its stated strategy to revitalize the brand.

Ralph Lauren (RL) and Michael Kors (KORS) saw a decline in same-store sales in 2015. After posting double-digit same-store sales from 1Q12 to 3Q14, KORS saw its comps drop. Kate Spade (KATE), however, has bucked the trend, posting double-digit comps growth in its last two quarters.

Outlook

Starting from a lower base, Coach’s performance may show improvement in future quarters. Coach is projecting positive comps in North America from fiscal 4Q16 onwards. However, spurring transaction growth may be a tall order in the face of steady declines in mall traffic. Coach’s performance, in that case, would depend on how much it can premiumize its offering, raise prices, and appeal to consumers across a spectrum of price points.