Gold and Other Precious Metals Fell on May 18

Gold futures for June expiration fell 0.47% and ended May 18 at $1,252.8 per ounce. The call implied volatility in gold rose to 11.3%.

May 22 2017, Published 11:29 a.m. ET

Precious metals fell

After the rise in precious metals on May 17 due to the fear of “Trump trade,” precious metals and mining shares were weak on Thursday. Gold futures for June expiration fell 0.47% and ended the day at $1,252.8 per ounce. The call implied volatility in gold rose to 11.3%. The call implied volatility measures the change in the price of an asset with respect to the changes in its call option.

Silver, platinum, and palladium followed gold and fell 1.4%, 0.98%, and 1.5%, respectively, on May 18. Silver closed at $16.7 per ounce. Platinum and palladium closed at $936.3 and $765.5 per ounce, respectively.

President Trump’s impact on precious metals seems to have settled down. However, concerns about political risk are still prevalent. The US dollar Index rose 0.31%. During rising uncertainty in the market, the US dollar rises because it’s considered a safe-haven asset. However, it’s subjective whether or not the dollar can be considered as a safe-haven asset.

Rate hike

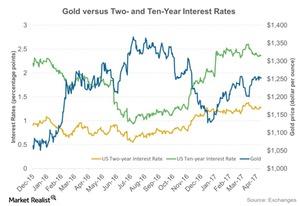

Another crucial factor that could be impacting precious metals was Minneapolis Fed President Neel Kashkari’s comments against the use of interest rate hikes to address unwanted asset bubbles. He said that bubbles are hard to identify and a rate hike could probably do more harm than good.

Speculations are rising about whether or not the Fed would increase the interest rate. Higher interest rates usually have a negative impact on gold and other precious metals. A rate hike could have a negative impact on mining funds like the SPDR Gold Shares (GLD) and the Physical Silver Shares (SIVR).

Mining shares that fell on May 18 included Harmony Gold (HMY), Pan American Silver (PAAS), New Gold (NGD), and Aurico Gold (AUQ).