How Did the Stock Market React to Dr Pepper Snapple’s 1Q16 Data?

Dr Pepper Snapple’s stock price appreciated by ~3% to $90.38 on April 27, in reaction to the company’s strong 1Q16 results and revised outlook.

Nov. 20 2020, Updated 3:54 p.m. ET

Stock rises on 1Q16 results

Dr Pepper Snapple’s (DPS) stock price appreciated by ~3% to $90.38 on April 27, in reaction to the company’s strong 1Q16 results and revised outlook. As discussed in parts one and two of this series, the company exceeded analysts’ earnings and sales estimates in 1Q16.

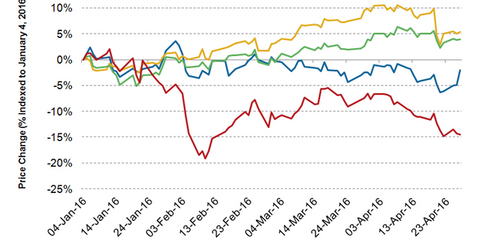

On a year-to-date basis, Dr Pepper Snapple’s stock price has declined by 2%. The stock prices of Coca-Cola (KO) and PepsiCo (PEP) have appreciated by 5.4% and 3.9%, respectively, since the start of 2016. The stock price of Monster Beverage (MNST) has declined by 14.5% since the start of the year.

Analyst recommendations

As of April 27, 16 of 23 analysts had a “hold” recommendation for Dr Pepper Snapple’s stock. Five analysts had a “buy” recommendation and two analysts had a “sell” recommendation. Dr Pepper Snapple delivered strong results in 2015 and continued its growth streak in 1Q16. However, about 80% of its volumes are exposed to the carbonated soft drink category, which is facing softness in demand due to the growing aversion to sugary beverages.

The 12-month price target for Dr Pepper Snapple’s stock is $95.71, which reflects a 5.9% upside potential. The PowerShares Dynamic Large Cap Growth ETF (PWB) has a 1.4% exposure to Dr Pepper Snapple.

Growth strategy

Dr Pepper Snapple is focused on the expansion of its noncarbonated beverage portfolio amid increasing demand for healthier beverage options. In early April, Dr Pepper Snapple increased its stake in BA Sports Nutrition, the makers of BodyArmor premium sports drinks, from 11.7% to 15.5%.

The company is also expanding its presence in emerging beverage categories through its partnership with allied brands. The company is seeing strong growth in allied brands such as Bai and FIJI Water. In the company’s 1Q16 conference call, Dr Pepper Snapple president and CEO Larry D. Young disclosed two new partnerships with allied brands:

- CORE Hydration, a purified water brand rich with electrolytes and minerals

- High Brew Coffee, a cold-brewed ready-to-drink coffee brand

Outlook revised

Dr Pepper Snapple expects its fiscal adjusted EPS (earnings per share) to be at the high end of the $4.20 to $4.30 guidance range that was issued in February 2016. The company now expects its fiscal 2016 net sales rise by ~2%, compared with the previous guidance of a 1% growth. The improvement in guidance came in as the company expects currency headwinds to have a lower impact on fiscal 2016 results. Dr Pepper Snapple now expects currency headwinds to negatively impact net sales by ~1% and adjusted EPS growth by about 2.5%. The previous guidance assumed currency headwinds would impact net sales by ~2% and adjusted EPS growth by 4%. For more updates, please visit our Nonalcoholic Beverages page.