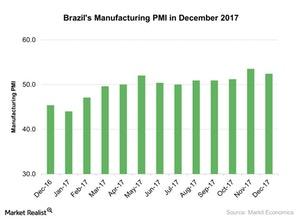

Analyzing Brazil’s Manufacturing PMI in December 2017

The final Markit Brazil manufacturing PMI stood at 52.4 in December compared to 53.5 in November 2017. The December PMI didn’t beat the initial estimate of 52.8.

Jan. 24 2018, Updated 7:33 a.m. ET

Brazil’s manufacturing PMI in December

According to data provided by Markit Economics, the final Markit Brazil manufacturing PMI (purchasing managers’ index) stood at 52.4 in December compared to 53.5 in November 2017. The December PMI didn’t beat the initial estimate of 52.8.

The weaker improvement in Brazil’s December manufacturing PMI was mostly due to the following factors:

- Production output and volume rose at a faster rate in December 2017, and it increased for the tenth consecutive month in December 2017.

- New business orders expanded at a higher rate in December. However, export orders improved at a softer rate in that month.

- Job growth in the manufacturing sector remained modest in December.

Performance of major ETFs in December

The iShares MSCI Brazil Capped ETF (EWZ), which tracks the performance of Brazil (FBZ), rose 5.6% in December 2017. The Direxion Daily MSCI Brazil Bull 3X ETF (BRZU) rose 15.2% in the same month.

The Brazilian economy showed a sharp fall in performance in December 2017. Higher inflation and unemployment have been major issues for the country’s economy for several years.

In the last one-year period, Brazil’s central bank has gradually reduced its key interest rate to control higher inflation in the economy. Among the developed nations (EFA), the US (SPY)(SPX-INDEX) and the UK (EWU)(UKX-INDEX) have been increasing their key interest rates slightly.

If Brazil’s manufacturing activity shows marked improvement, we could expect to see improvement in its economy in the near term.

In the next part of this series, we’ll analyze the performance of Brazil’s services PMI in December 2017.