What Do Analysts’ Ratings Suggest for Wells Fargo in 2017?

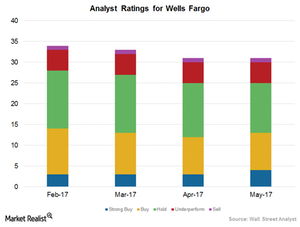

In May, 13 of the 31 analysts covering Wells Fargo rated the stock as a “buy,” 12 analysts rated it as a “hold,” and six analysts rated it as a “sell.”

May 16 2017, Updated 2:06 p.m. ET

Analysts’ ratings

In May 2017, 13 of the 31 analysts covering Wells Fargo (WFC) rated the stock as a “buy” or “strong buy,” 12 analysts rated it as a “hold,” and six analysts rated it as “underperform” or “sell.” Wells Fargo’s one-year mean price target is $57.81 per share, which implies an 8.4% rise from its current level—compared to 10.5% growth in 2016.

Peers’ Ratings

Among Wells Fargo’s competitors, 16 of the 29 analysts covering JPMorgan Chase (JPM) rated the stock as a “buy” or “strong buy”—compared to 18 analysts in January 2017. For Bank of America (BAC), 23 of the 31 analysts covering its stock rated it as a “buy” or “strong buy” in May 2017—compared to 24 out of 31 analysts in the previous month. Seven analysts rated the company as a “hold” and one analyst rated it as a “sell”—six analysts rated it as a “hold” in the previous month.

For Citigroup (C), 18 of the 29 analysts rated it as a “buy” or “strong buy” in May 2017—compared to 17 out of 29 analysts in the previous month. Eight analysts rated it as a “hold,” while three analysts rated it as “underperform” or “sell.”

Together, Wells Fargo’s peers account for 28.5% of the Financial Select Sector SPDR ETF (XLF).