What Investors Should Know about Century Aluminum’s 1Q17 Results

Century Aluminum (CENX) was among the best-performing aluminum stocks (NHYDY) (ACH) (SOUHY) last year with gains of 94%.

April 26 2017, Updated 12:36 p.m. ET

Century Aluminum’s 1Q17 earnings

Century Aluminum (CENX) was among the best-performing aluminum stocks (NHYDY) (ACH) (SOUHY) last year with gains of 94%. The stock has continued its good run in 2017. It has risen almost 60% as of April 25. Century Aluminum released its 1Q17 earnings on April 25 after markets closed. In this article, we’ll look at the key takeaways from Century Aluminum’s 1Q17 earnings.

Key takeaways

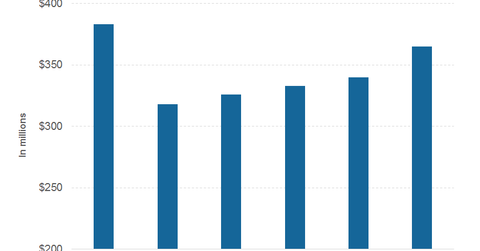

- Century Aluminum posted revenues of $365 million in 1Q17. In contrast, it posted revenue of $340 million in 4Q16 and $319 million in 1Q16.

- The company shipped 186,395 metric tons of aluminum in 1Q17 as compared to 183,210 metric tons in the sequential quarter.

- Century Aluminum’s 1Q17 adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) rose to $22.2 million in 1Q17 as compared to $11.9 million in 4Q16. While higher aluminum prices boosted Century Aluminum’s 1Q17 earnings, they were partially offset by higher input costs, especially alumina prices.

- Century Aluminum posted an adjusted net loss of $5 million in 1Q17 versus an adjusted net loss of $11.5 million in 4Q16.

- Century Aluminum posted negative free cash flows of $6 million in 1Q17. Though the company’s positive EBITDA and Ravenswood plant sale positively contributed to its cash flows, higher working capital investments were a drag on its 1Q17 cash flows.

Speaking on the industry outlook (XME), Mike Bless, Century Aluminum’s CEO, said, “Industry conditions remain mixed.” He also added, “Our markets in the U.S. and Europe continue to be distorted by significant trade flows caused by the illegally subsidized excess capacity and production in China.”

Meanwhile, Alcoa sounded positive on the aluminum industry’s outlook during its 1Q17 earnings call. You can read Alcoa Maintains 2017 Guidance, Ups Demand Forecast for a look at Alcoa management’s views on the industry outlook.

Continue to the next article for an analysis of Arconic’s 1Q17 results.