Apache Stock: What Are Analysts’ Recommendations?

On June 11, Argus upgraded Apache stock from “hold” to “buy.” On March 7, UBS initiated coverage on Apache stock with a “sell” rating.

Nov. 20 2020, Updated 11:44 a.m. ET

Consensus ratings for Apache

Approximately 48.3% of the analysts rated Apache (APA) as a “hold,” ~17.2% rated it as a “buy,” and ~21% rated it as “underperform.”

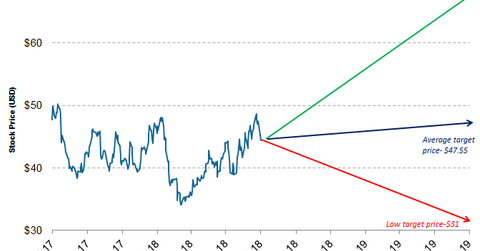

The average target price of $47.55 for Apache implies a return of ~6.95% over the next 12 months. Whiting Petroleum (WLL) has a potential return of 10.51% over the next 12 months. Cimarex Energy (XEC) has a potential return of 30.56% during the same period. Carrizo Oil & Gas (CRZO) has potential returns of 9.54% over the next 12 months.

The highest target price provided by an analyst for Apache stock is $67, while the lowest target price provided for the stock is ~$31.

Recent upgrades and downgrades

On June 11, Argus upgraded Apache stock from “hold” to “buy.” On March 7, UBS initiated coverage on Apache stock with a “sell” rating.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!