Marathon Petroleum on the Street: What’s Changed among Analysts?

Of the 19 analysts covering MPC, 17 (89%) analysts have assigned “buy” or “strong buy” ratings, while two (11%) have assigned “hold” ratings.

April 19 2017, Updated 7:36 a.m. ET

Analyst ratings for MPC

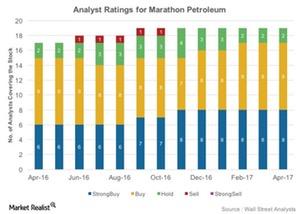

Of the 19 analysts covering Marathon Petroleum (MPC), 17 (89%) analysts have assigned “buy” or “strong buy” ratings, while two (11%) have assigned “hold” ratings, and no one has assigned “sell” or “strong sell” rating. MPC’s mean target price of $61 per share implies a 25% gain from its current level. (For more on why most analysts have rated MPC a “buy,” please refer to “Why So Many Analysts Are Rating Marathon Petroleum as a ‘Buy?’”)

Changes in analyst ratings for MPC

Analyst ratings for Marathon Petroleum have improved as compared to April 2016, when MPC had fewer “buy” ratings. But MPC has witnessed cuts in its target prices issued by various investment banking firms.

Specifically, J.P. Morgan cut MPC’s target price to $59 per share from $62. The firm has an “overweight” rating on the stock. Morgan Stanley has lowered MPC’s target price to $66 from $70.

Peer ratings

By comparison, peers Delek US Holdings (DK), HollyFrontier (HFC), and Western Refining (WNR) have been rated as a “buy” by 33%, 29%, and 17% of analysts, respectively. Downstream players PBF Energy (PBF) and Alon USA Energy (ALJ) have been rated as a “buy” by 35% and 11% of analysts, respectively.

For exposure to small-cap value stocks, you might consider the iShares Russell 2000 Value ETF (IWN). IWN has ~5% exposure to energy sector stocks including DK, WNR, and ALJ.

Now let’s discuss implied volatility.