Inside Pfizer’s Performance in 3Q17

PFE stock rose ~7.3% in 3Q17 and has risen ~11.3% YTD (year-to-date) as of October 16.

Oct. 19 2017, Updated 7:39 a.m. ET

A look at Pfizer

Headquartered in New York City, Pfizer (PFE) is one of the largest pharmaceutical companies in the world. The company’s product portfolio is segregated into two businesses: Innovative Health and Essential Health.

PFE stock rose ~7.3% in 3Q17 and has risen ~11.3% YTD (year-to-date) as of October 16.

Analysts’ recommendations

Wall Street analysts estimate that the stock has the potential to return ~5.8% over the next 12 months. These recommendations show a 12-month target price of $38.20 per share, compared with $36.34 on October 16.

Of the 22 analysts tracking PFE stock, 12 recommend a “buy,” while nine recommend a “hold,” and one recommends a “sell.” The consensus rating for the stock stands at 2.50, which represents a moderate “buy” for value investors.

Analysts’ revenue estimates

Pfizer’s revenues are driven by pharmaceutical products like Lyrica, Ibrance, Eliquis, Xeljanz, and Xtandi, in addition to higher alliance revenues.

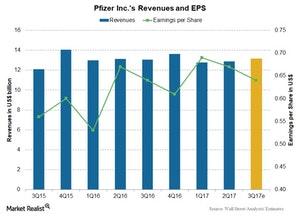

Wall Street analysts estimate that Pfizer will see revenues of ~$13.2 billion in 3Q17, which would represent a 0.9% year-over-year rise in revenues, and earnings per share of $0.64.

To divest company-specific risks, investors can consider ETFs like the iShares Edge MSCI Multifactor Healthcare ETF (HCRF), which has 4.4% of its total assets in Pfizer (PFE). HCRF also has 3.3% in Humana (HUM), 3.7% in Merck (MRK), and 10.4% in Johnson & Johnson (JNJ).