Why Foreign Portfolio Investment in India Is Rising in 2017

For the first time since the 2008 financial crisis, FPI in 2015–2016 saw net outflows of about 181 billion rupees as compared to an inflow of about 2,274 billion rupees in 2014–15.

Nov. 20 2020, Updated 1:42 p.m. ET

Foreign portfolio investments in 2017

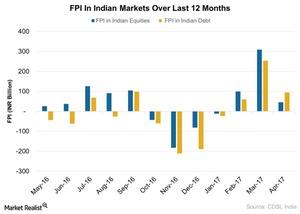

Foreign portfolio investment (or FPI) is investment by non-residents in Indian markets. The investments can flow in securities including stocks, government bonds, corporate bonds, convertible securities, and infrastructure securities. The Indian government has taken several measures to boost foreign investments in both equity and debt since 2014. The Securities and Exchange Board of India’s (or SEBI) FPI regulation of 2014 encourages and simplifies foreign portfolio investments in India. Let’s look at FPI in India in the below charts as of April 2017.

Volatile FPI in Indian markets

For the first time since the 2008 financial crisis, FPI in 2015–2016 saw net outflows of about 181 billion rupees as compared to an inflow of about 2,274 billion rupees in 2014–15. The FPI flows in the last two years seem to be on the lower side as compared to the average FPI inflows between 2012 and 2014. The turbulence in the global markets had led to an outflow of FPI during this period.

FPI as of March 2017

However, foreign investors pushed a record 557 billion rupees in Indian capital markets in March 2017. The increased investment was mainly due to the expectations of Bharatiya Janta Party’s (or BJP) victory in assembly polls to bring about bold reforms in 2017. The debt market seems to have suffered from large outflows as compared to the equities market in 2016–17. The massive pull-out has mostly occurred since President Trump’s victory and is in part due to the likely rise in interest rates.

However, the FPI flow in Indian ETFs has increased in the first couple of months in 2017. The Indian equities seem to be prime beneficiaries due to their recent outperformance against the MSCI EM Index (EEM). The domestic investors appear to have high expectations of policy reforms from the ruling government following their big win in the state elections.

The iShares MSCI India ETF (INDA) rose about 18%, outperforming the EEM in 2017 from January 1 to April 5, 2017. The EEM has risen about 13% in the same period. Some of the stocks in the INDA to watch include Housing Development Finance (HDFC), Reliance Industries (RELIANCE), Infosys (INFY), and Tata Consultancy Services (TCS).

Let’s look at GDP growth expectations for India, driven by policy reforms in our next article.