A Unified Structure for BHP: Do the Costs Outweigh the Benefits?

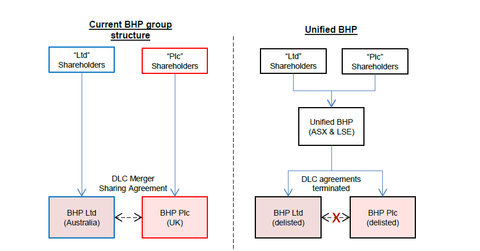

Elliott Funds has proposed unifying BHP Billiton’s (BHP) (BBL) dual-listing structure into a single Australian-headquartered and Australian tax resident–listed company.

April 13 2017, Updated 1:55 a.m. ET

Dual-listing structure

Elliott Funds has proposed unifying BHP Billiton’s (BHP) (BBL) dual-listing structure into a single Australian-headquartered and Australian tax resident–listed company.

According to Elliott, after the South32 (SOUHY) demerger, the PLC (UK listing) generates ~8.9% of BHP’s EBITDA (earnings before interest, tax, depreciation, and amortization), but its shares account for ~39.7% of the company’s aggregate issued shares.

This misalignment between its profits and shareholder base has led to a huge build-up of franking credits, which total $9.7 billion, or ~10% of the company’s current market capitalization.

Elliott believes that these franking credits are not being properly valued by the market. A unification would eliminate the current trading value mismatch between the two lines of shares.

BHP’s response

BHP stated in a press release that while it’s kept its dual-listing structure under review, it hasn’t identified “sufficient benefits to outweigh the significant costs which would be incurred in unifying the DLC.” This unification would also require the approval of the Australian Foreign Investment Review Board. In a more detailed response, BHP mentioned that this structure would make off-market buybacks less attractive.

An analyst at Morgan Stanley (MS) has noted that while unifying the shareholder structure has the potential to release ~$4 billion in franking credits, it’ll take ~21 years for shareholders to benefit, according to the current regime’s rules.

Investors should note that Rio Tinto (RIO) also has a dual-listed company structure. Earlier this year, Paul Singer’s Elliott Funds also wanted to replace Arconic’s (ARNC) chair, Klaus Kleinfeld. Arconic was spun off from Alcoa (AA).