Arconic Inc

Latest Arconic Inc News and Updates

Arconic’s Tough Beginning: Controversies and Battles

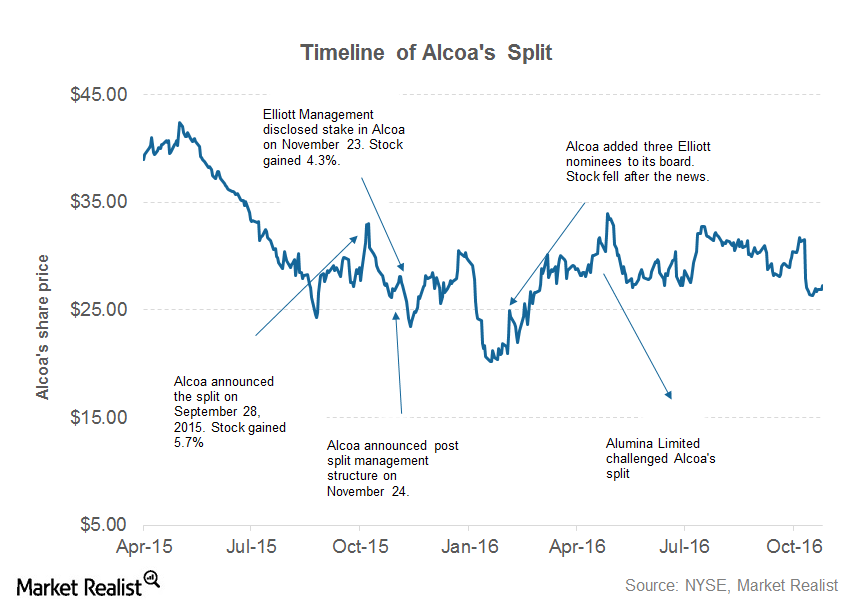

Arconic is scheduled to release its 1Q17 earnings on April 25. ARNC was listed as a separate entity on November 1, 2016, when Alcoa split into two entities.

Should Alcoa Bears Like Their Chances in 2017?

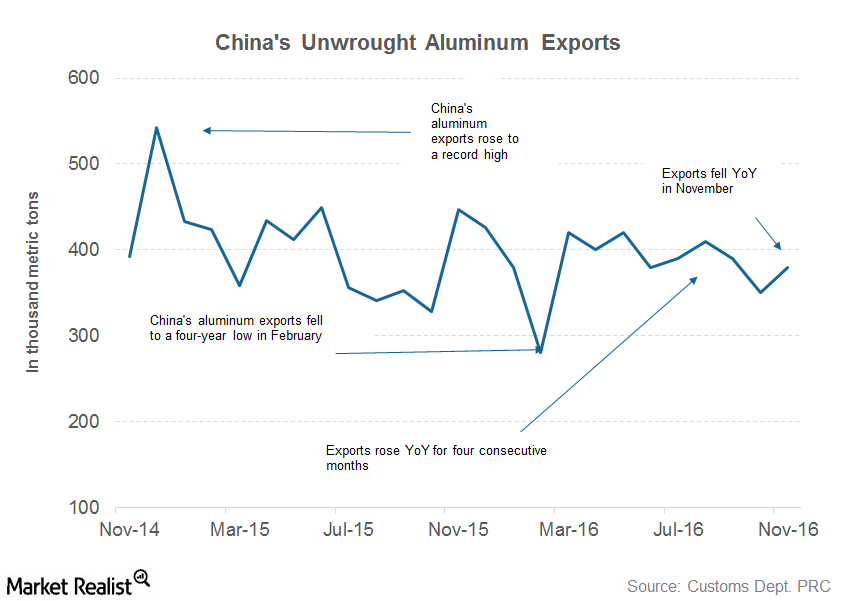

Higher Chinese aluminum production could spoil the party that companies such as Alcoa and Century Aluminum (CENX) are currently enjoying.

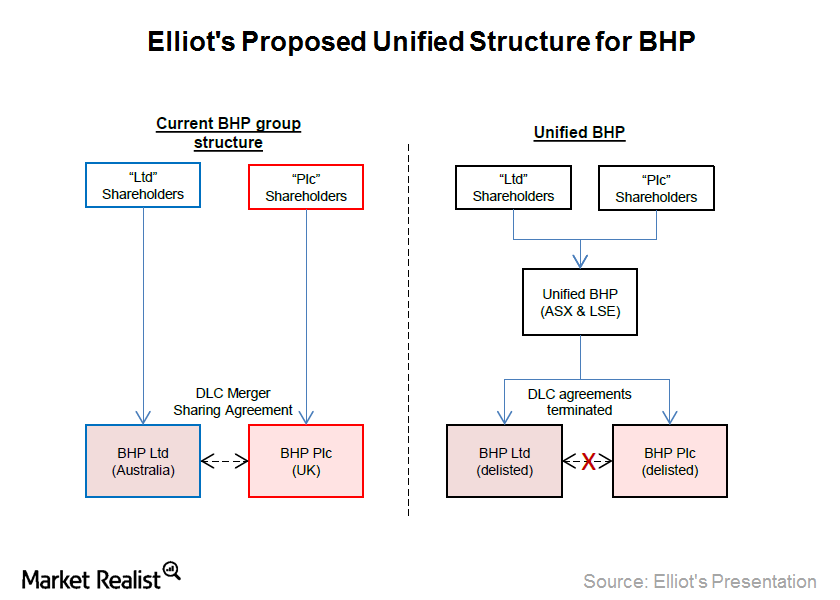

A Unified Structure for BHP: Do the Costs Outweigh the Benefits?

Elliott Funds has proposed unifying BHP Billiton’s (BHP) (BBL) dual-listing structure into a single Australian-headquartered and Australian tax resident–listed company.

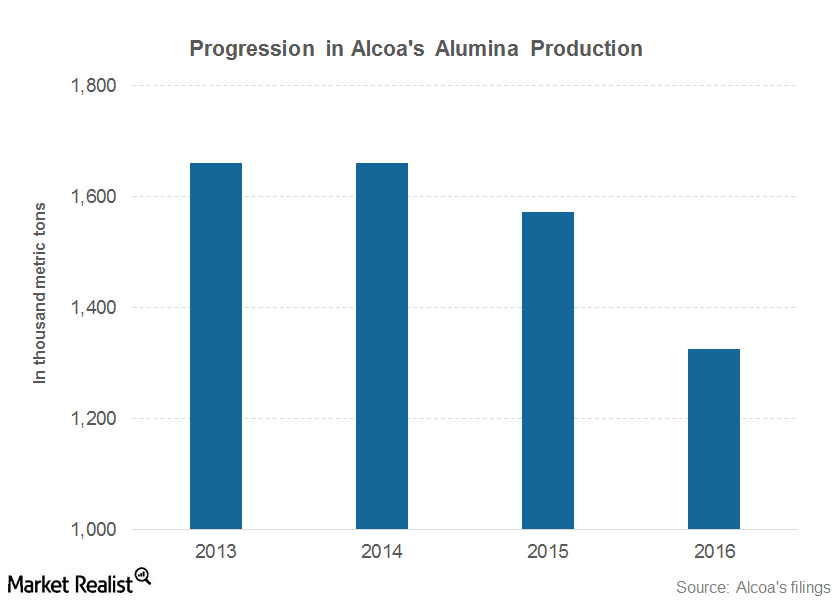

Alcoa’s 2017 Guidance: Everything You Need to Know

Alcoa (AA) expects its alumina shipments to range from 13.8 million–13.9 million metric tons in fiscal 2017 compared to 13.2 million metric tons in fiscal 2016.