Eli Lilly’s 1Q17 Estimates for Humalog, Other Endocrine Products

Eli Lilly’s (LLY) human pharmaceutical segment contributes ~85.0% to Lilly’s total revenues.

April 21 2017, Updated 7:36 a.m. ET

Human pharmaceutical segment

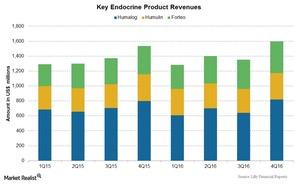

Eli Lilly and Company’s (LLY) human pharmaceutical segment contributes ~85.0% to Lilly’s total revenues. The segment deals with various therapeutic areas, including endocrine, neuroscience, oncology, cardiovascular, and others. Let’s look now at the expectations for Humalog and other endocrine products in 1Q17.

Humalog

Humalog, a diabetes drug, is expected to report lower sales in 1Q17. Volume growth will be offset by lower prices and the negative impact of foreign exchange. Humalog competes with NovoLog from Novo Nordisk (NVO). A biosimilar for Humalog is being developed by Sanofi (SNY).

Other endocrine products

Apart from Humalog, the endocrine franchise also includes Humulin and Forteo. The contribution of these products is more than 35.0% to Lilly’s total revenues.

Humulin

The Humulin portfolio consists of concentrated insulin products used to lower blood sugar levels in patients with diabetes mellitus. Sales of Humulin products in 1Q17 are expected to rise in US markets due to higher demand. Growth is expected to fall in international markets.

Forteo

Forteo, another blockbuster drug from Lilly, is used in the treatment of osteoporosis. Sales of Forteo are expected to rise in 1Q17, mainly due to a higher demand in US markets. Growth will be partially offset by lower realized prices due to the price revision in Japan and the negative impact of foreign exchange in international markets.

Some other drugs for osteoporosis include Boniva from Roche’s (RHHBY) subsidiary Genentech and Actonel from Allergan (AGN).

To divest the company-specific risks, you can consider ETFs such as the iShares Core High Dividend (HDV), which holds 1.5% of its total assets in Eli Lilly.