Correlation Trends of Miners to Gold

Among the leveraged mining funds, the Direxion Daily Gold Miners ETF (NUGT) and the Proshares Ultra Silver ETF (AGQ) have seen considerable losses over the past month.

May 1 2017, Updated 7:41 a.m. ET

Mining stocks and precious metals

As global tumult grips markets and investors are turning to mining stocks as safe havens, it’s crucial to understand which stocks are closely tied to precious metals. Stocks with higher correlations to precious metals could be impacted more by global indicators that influence precious metals.

It’s widely expected that precious metal mining stocks will follow the direction of precious metals. However, on a day-to-day basis, the correlation may not be as strong.

Among the leveraged mining funds, the Direxion Daily Gold Miners ETF (NUGT) and the Proshares Ultra Silver ETF (AGQ) have seen considerable losses over the past month. These two funds dropped 8.6% and 8%, respectively.

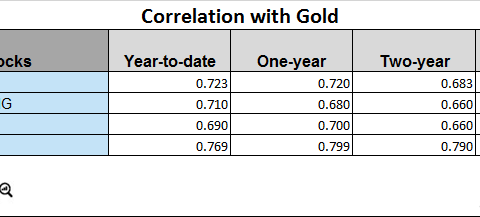

Among New Gold (NGD), Newmont Mining (NEM), Sibanye Gold (SBGL), and Gold Fields (GFI), Sibnaye has the lowest correlation with gold, while Gold Fields has the highest correlation with gold. Over the past three years, all four stocks have seen upward scaling correlation to gold.

Metal investors should study upward and downward trends, as price change predictability can be affected by the rise and fall in precious metal prices.

Upward-trending correlations

Gold Fields’ correlation with gold has dropped from a three-year correlation of ~0.77 to a year-to-date correlation of ~0.80. A correlation of ~0.80 means that ~80% of the time, Gold Field has moved in the same direction as gold.