Behind Mining RSI Levels and Volatility Now

Leveraged mining funds including the Direxion Daily Gold Miners (NUGT) and the Proshares Ultra Silver (AGQ) saw big jumps in early 2017 due to the revival in precious metals.

April 17 2017, Published 12:38 p.m. ET

Precious metal funds

As investors analyze which mining stocks are most closely linked to gold, it’s also important that they view the essential technicals of the miners they are considering.

Specifically, leveraged mining funds including the Direxion Daily Gold Miners (NUGT) and the Proshares Ultra Silver (AGQ) saw substantial rises at the beginning of 2017 due to the revival in precious metals.

Implied volatility

Call implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option. During times of global and economic turbulence, volatility is higher than during a stagnant economy.

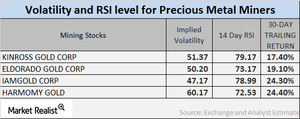

As of April 10, 2017, the volatilities of Kinross Gold (KGC), Eldorado Gold (EGO), IamGold (IAG), and Harmony Gold (HMY) were 51.4%, 50.2%, 47.2%, and 60.2%, respectively. Remember, a mining company’s volatility is often higher than the precious metal’s volatility.

RSI levels

A 14-day RSI above 70 indicates the possibility of a downward movement in a stock’s price, whereas a level below 30 shows the possibility of an upward movement in a stock’s price. The RSI levels of the four mining giants mentioned above have all risen due to higher stock prices.

Kinross, Eldorado, and Iamgold, and Harmony have RSI levels of 79.2, 73.2, 79, and 72.5, respectively. With the rising prices of these mining stocks, the RSI levels of the respective stocks have risen. Most miners are trading close to 70. The 30-day-trailing returns of these miners have also improved substantially.