Analysts’ Recommendations for AstraZeneca in 2Q17

Wall Street analysts expect AstraZeneca’s top line to fall ~9.5% to $5.1 billion in 2Q17, compared to $5.6 billion in 2Q16. Its earnings per share are expected to be $0.42 in 2Q17.

July 27 2017, Updated 7:44 a.m. ET

Analysts’ estimates

Wall Street analysts expect AstraZeneca’s (AZN) top line to fall ~9.5% to $5.1 billion in 2Q17, compared to $5.6 billion in 2Q16. Its earnings per share (or EPS) are expected to be $0.42 in 2Q17.

Analysts’ ratings

AstraZeneca’s stock price has risen nearly 8.5% over the last 12 months. and it’s risen ~23.7% year-to-date. Analysts’ estimates show that the stock has the potential to return ~3.2% over the next 12 months. Their recommendations show a 12-month target price of $34.87, compared to AZN’s price of $33.78 on July 25, 2017.

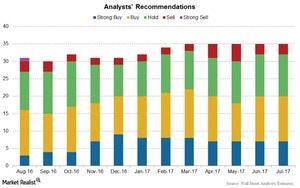

Analysts’ recommendations

As of July 26, 2017, three analysts are tracking AstraZeneca’s American depositary receipt listed on the NYSE. Of these three analysts, two analysts recommend “buys” on the stock, and one recommends a “hold.” The consensus rating for AstraZeneca is 1.7, which represents a moderate “buy” for momentum investors.

AstraZeneca has its headquarters in the United Kingdom, so its stock is listed on the London Stock Exchange. A total of 35 analysts are tracking AstraZeneca on the London Stock Exchange. Of these, 20 analysts recommend “buys” on the stock, 12 analysts recommend “holds,” and three analysts recommend “sells.”

The stock’s price has risen ~10.4% over the last 12 months and ~15.4% year-to-date. The consensus rating on AstraZeneca stock stands at 2.3, which represents a moderate “buy” for long-term and value investors.

Valuation multiples

As on July 26, 2017, AstraZeneca is trading at a forward PE (price-to-earnings ratio) of 18.1x, compared to the industry average of 16.8x. AZN’s forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple is 13.8x, compared to the industry average of 14.1x.

To divest risk, investors can consider ETFs such as the VanEck Vectors Pharmaceutical ETF (PPH), which holds 4.9% of its total assets in AstraZeneca. PPH also holds 8.6% in Johnson & Johnson (JNJ), 5.0% in Novo Nordisk (NVO), and 4.7% in Teva Pharmaceutical (TEVA).