Why Most Analysts’ Ratings for Tesoro Are ‘Buys’

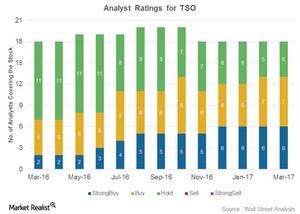

Thirteen out of the 18 analysts covering Tesoro (TSO) have rated it as a “buy” so far in March 2017. Another five analysts have rated TSO as a “hold.”

March 23 2017, Updated 12:36 p.m. ET

Analysts’ ratings for Tesoro

Thirteen out of the 18 analysts covering Tesoro (TSO) have rated it as a “buy” so far in March 2017. Another five analysts have rated TSO as a “hold.”

TSO’s mean price target of $106 per share implies a rise of ~29% from its current level.

Changes in analysts’ ratings

Compared to March 2016, analysts’ ratings for Tesoro have improved. In March 2016, TSO had fewer “buy” ratings and more “hold” ratings.

However, following its 4Q16 earnings, Tesoro witnessed cuts in its target prices by various investment banking companies, perhaps because its 4Q16 earnings fell 98% year-over-year and 97% quarter-over-quarter.

Morgan Stanley cut TSO’s target price from $107 to $100. JPMorgan Chase, which had an “overweight” rating on the stock, lowered its target price from $99 to $98.

So why the “buys”?

Tesoro currently has expansion, modernization, and integration activities ongoing in its Refining, Midstream, and Marketing segments. The company expects to fully integrate its downstream model to derive value from every molecule of hydrocarbon processed.

With these expansion activities, Tesoro is all set to take advantage of an improved refining environment. The company is also focusing on increasing its stable midstream and marketing earnings to shield itself from volatility in the refining environment. Plus, its acquisition of Western Refining (WNR) is likely to provide a significant boost to its growth trajectory. No wonder the majority of analysts call Tesoro a “buy.”

Peers’ ratings

Tesoro’s peers Valero Energy (VLO) and Marathon Petroleum (MPC) have been rated as “buys” by 62% and 90% of analysts, respectively. Other small players Delek US Holdings (DK), Alon USA Energy (ALJ), and Western Refining have been rated as “buys” by 35%, 25%, and 25% of analysts, respectively.

For exposure to small-cap value stocks, you can consider the iShares Russell 2000 Value ETF (IWN). The ETF has ~5% exposure to energy sector stocks, including DK, WNR, and ALJ.

Move on to the next article to learn about how Tesoro’s dividend yield has trended.