Why Investors Are Moving to Index Funds

Index funds have recently gained popularity since actively managed funds haven’t been able to capture investors’ return expectations.

Nov. 20 2020, Updated 1:10 p.m. ET

Market sentiment drives index funds

John Levin, chief executive officer and portfolio manager of Levin Capital Strategies, believes that index funds currently depict market sentiment. Index funds have recently gained popularity since actively managed funds haven’t been able to capture investors’ return expectations.

Index funds are considered to be passively managed. They track market indexes such as the S&P 500 (SPX-INDEX) and provide investors with broad market exposure, low operating expenses, and low portfolio turnover. The biggest benefit is that they are less expensive than actively managed funds.

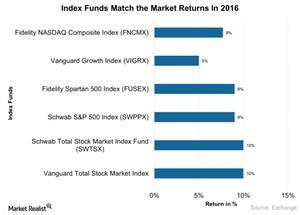

You can invest in market indexes through mutual funds and ETFs. Index funds track ETFs such as the SPDR S&P 500 ETF (SPY) and the iShares Core S&P 500 (IVV). You can see the performances of some of the index funds in the graph below.

Fund performances in 2016

Most of the funds in the above graph tracked the S&P 500 Index (SPX-INDEX), which consists of about 500 US large-cap companies. The Schwab S&P 500 Index (SWPPX) and the Fidelity Spartan 500 Index (FUSEX) each rose 9.0% in 2016, closely tracking the 9.0% return of the S&P 500.

The Vanguard Total Stock Market Index and the Schwab Total Stock Market Index Fund (SWTSX) posted slightly above its benchmark at 10.0% in 2016. It was followed by the Fidelity NASDAQ Composite Index (FNCMX) and the Vanguard Growth Index (VIGRX), which rose 8.0% and 5.0%, respectively, in 2016.

Some of the top holdings of these funds include Apple (AAPL), Microsoft (MSFT), ExxonMobil (XOM), and Johnson & Johnson (JNJ).

Next, let’s look at the performances of some of the index funds in detail.