What Scenarios Decide How Precious Metals Move?

The directional move of the interest rate is a crucial determinant of the direction precious metals will take.

March 9 2017, Published 1:03 p.m. ET

Precious metal fluctuations

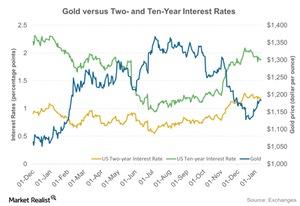

The directional move of the interest rate is a crucial determinant of the direction precious metals will take. The relationship between precious metals such as gold and silver and US Treasuries is inverse most of the time. The higher the interest rate offered on Treasuries, the lower the demand for precious metals that don’t have any intermediary cash flows.

Along with the rate for US Treasuries, global policies also play a role in deciding the movement of precious metals. The markets have been closely watching the monetary policy decisions of the European Central Bank. Monetary policies for major world economies also have a significant impact on precious metals. Expansionary monetary policies often cause investors to not like gold.

The above graph shows the fluctuations in the price of gold as they relate to changes in the US two- and ten-year interest rates.

Interest rates and gold

Recent falls in the prices of gold and silver are most likely due to the possible interest rate hike suggested by Fed chair Janet Yellen over the past week.

The falls in gold and silver have also affected funds that follow gold and silver such as the ETFS Physical Swiss Gold (SGOL) and the ETFS Physical Silver (SIVR). These two funds fell 2.9% and 4.6%, respectively, during the past 30 trading days.

Mining stocks that have also fallen include B2Gold (BTG), Royal Gold (RGLD), Goldcorp (GG), and Newmont Mining (NEM). These four stocks fell 15.8%, 12.3%, 11.9%, and 11.6%, respectively, on a 30-day trailing basis. Combined, these four miners make up about 19.0% of the price changes in the VanEck Vectors Gold Miners ETF (GDX).