Understanding the Latest Implied Volatility in Refining Stocks

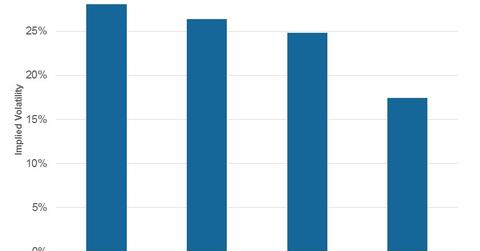

Marathon Petroleum’s implied volatility currently stands at 28%—the highest level among peers Valero, Tesoro, and Phillips 66.

March 7 2017, Updated 9:06 a.m. ET

Refining stocks’ implied volatilities

Marathon Petroleum’s (MPC) implied volatility currently stands at 28%. This is the highest level among peers Valero Energy (VLO), Tesoro (TSO), and Phillips 66 (PSX). By contrast, Phillips 66 (PSX) has the lowest implied volatility standing at 17%.

VLO and TSO currently have implied volatilities of 25% and 26%, respectively. For exposure to these stocks, investors can consider the iShares North American Natural Resources ETF (IGE). The ETF has ~7% exposure to refining and marketing sector stocks.

In the next part of this series, we’ll discuss how refining stocks valuations are placed as compared to their historical values.