Sandoz: Novartis’s Generics Business in 2016

Sandoz, the generics arm of Novartis (NVS), is the number two generic medicines provider worldwide, and it’s number one in differentiated generics.

March 27 2017, Updated 10:37 a.m. ET

Sandoz, the generics segment

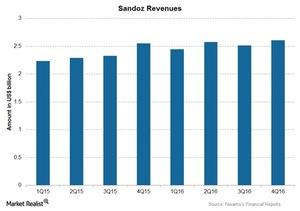

Sandoz, the generics arm of Novartis (NVS), is the number two generic medicines provider worldwide, and it’s number one in differentiated generics, including products that are difficult to develop and manufacture. In 2016, Sandoz contributed ~20.9% of its total revenue at $10.1 billion.

Sandoz reported a rise of 2% in its 2016 revenue at a constant exchange rate. Its operational growth was driven by an 8% rise in its volumes, substantially offset by a 6% fall due to price erosion.

Performance of Sandoz products

Sandoz’s revenue drivers are biopharmaceuticals, including biosimilars and Glatopa. The segment’s growth was reported across all regions worldwide. In US markets, its reported revenue for 2016 was $3.7 billion, a 1% rise at a constant exchange rate compared to 2015.

European markets reported a 7% rise in revenue at a constant exchange rate to $4.4 billion, driven by strong sales in the region. Canadian and Latin American markets reported a rise of 9% at a constant exchange rate during 2016, while Asian, African, and Australasian markets reported a fall of 3% at a constant exchange rate.

Biopharmaceuticals

The global sales of biopharmaceuticals rose 31% at a constant exchange rate to $1.0 billion in 2016. These sales included revenue from biosimilars, biopharmaceutical contract manufacturing, and Glatopa. The growth came mainly from the three in-market biosimilars Omnitrope (somatropin), Binocrit (epoetin alfa), and Zarzio/Zarxio (filgrastim), along with the strong performance of Glatopa in US markets.

Glatopa (glatiramer acetate) injection is the first generic version of Teva Pharmaceutical’s (TEVA) Copaxone 20mg used for the treatment of relapsing forms of multiple sclerosis.

Anti-infective franchise

The segment’s anti-infective franchise reported a fall of 2% in revenue at a constant exchange rate at $1.4 billion in 2016. Sandoz discontinued its low-margin products, which led to an overall fall in the franchise’s revenue.

To divest company-specific risk, investors can consider ETFs such as the PowerShares International Dividend Achievers ETF (PID) which holds ~1.1% of its total assets in Novartis, 2.3% in GlaxoSmithKline (GSK), 1.5% in Sanofi (SNY), and 1.1% in Teva Pharmaceutical.