Refining Stock Betas: Who Could Pop?

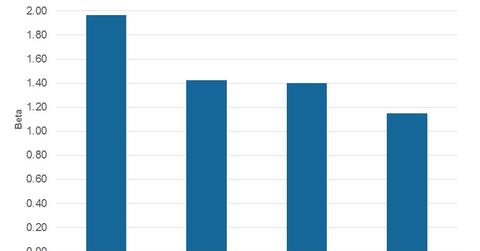

On March 2, 2017, Marathon Petroleum’s 90-day beta stood at 2.0—the highest among peers Valero, Tesoro, and Phillips 66.

March 6 2017, Updated 9:06 a.m. ET

Refining stock betas

In this part of our series, we’ll compare beta of refining stocks. We’ve considered a 90-day beta, which depicts how much a stock moves for a given move in the market, daily, for 90 days. On March 2, 2017, Marathon Petroleum’s (MPC) 90-day beta stood at 2.0. This was the highest among peers Valero Energy (VLO), Tesoro (TSO), and Phillips 66 (PSX). Notably, PSX had the lowest beta standing at 1.1.

TSO and VLO had their beta’s standing at 1.4 each. For exposure to refining and marketing sector stocks, investors can consider the iShares North American Natural Resources ETF (IGE). The ETF has ~7% exposure to the sector.

Continue to the next part for a discussion of recent changes in the institutional holdings in refining stocks.