Reading Mining Companies’ Volatilities and RSI Levels

Mining companies’ volatilities are significant to the buying process. The mining shares we’ve selected in this article are Kinross Gold, Eldorado Gold, IAMGOLD, and Harmony Gold.

March 21 2017, Published 2:11 p.m. ET

Leveraged mining funds

As we analyze the impact of the Federal Reserve’s interest rate hike on precious metals, it’s also crucial to analyze the performances of mining stocks and funds.

Leveraged mining funds such as the Direxion Daily Gold Miners ETF (NUGT) and the ProShares Ultra Silver ETF (AGQ) are closely linked to their respective funds. These two funds have seen year-to-date rises of 16.8% and 17.3%, respectively. Often, leveraged funds are very volatile and can be relatively risky for the average investor.

Mining companies’ volatilities are significant to the buying process. The mining shares we’ve selected in this article are Kinross Gold (KGC), Eldorado Gold (EGO), IAMGOLD (IAG), and Harmony Gold (HMY).

Miners’ volatilities

Call-implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option. During times of global and economic turbulence, volatility tends to be higher than it is in a stagnant economy.

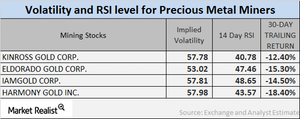

On March 1, 2017, the volatilities of Kinross, Eldorado, IAMGOLD, and Harmony were 57.8%, 53%, 57.8%, and 58%, respectively. Remember, mining companies’ volatilities are often higher than those of precious metals.

RSI levels

A 14-day RSI (relative strength index) of above 70 indicates the possibility of downward movement in a stock’s price. An RSI level of below 30 indicates the possibility of upward movement in a stock’s price.

The RSI levels of the four above-mentioned miners have risen due to their rising stock prices. Kinross, Eldorado, IAMGOLD, and Harmony have RSI levels of 40.8, 47.5, 48.7, and 43.6, respectively.