Valuations in Gold: Where’s the Upside among Miners Today?

Among senior gold miners, Goldcorp is trading at the highest multiple of 10.3x—a premium of 31% compared to the peer average.

Nov. 20 2020, Updated 1:01 p.m. ET

Valuation multiple

The EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) valuation multiple is a good measure for capital-intensive industries. This metric helps investors compare companies with various capital structures.

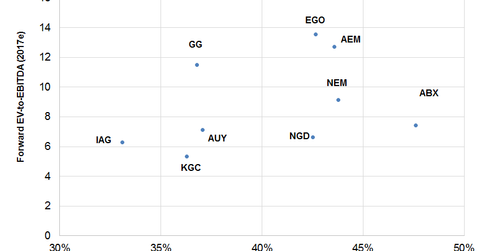

The chart above compares gold miners’ EV-to-forward-EBITDA to the EBITDA margin from 2017. More specifically, EV refers the total market value of a company’s debt, equity, preferred shares, and minority interests, net of cash and equivalents, and investments in associates.

Is Goldcorp’s premium justified?

Among senior gold miners, Goldcorp (GG) is trading at the highest multiple of 10.3x, which represents a premium of 31% as compared to the peer average. However, investors should note that Goldcorp’s premium to other miners has narrowed. Its past five-year historical average premium was 41%.

The bright side to this story is that Goldcorp may have reached its lowest point in operational performance, which means that it could see better prospects on the horizon. Goldcorp still has one of the best long-term organic growth production profiles, with a good execution track record from its management.

Could Newmont Mining re-rate?

Newmont Mining (NEM) has a multiple of 8.6x, with an EBITDA margin of 36%. Its higher gold price leverage and falling financial leverage have been the main drivers of its significant re-rating since the beginning of 2016. Its unit costs will have to fall in line with peers for it to be re-rated significantly.

Barrick Gold

Barrick Gold’s (ABX) high financial leverage has been a cause of concern for investors. Despite having the highest EBITDA margin among peers at 48.6%, it’s trading at a multiple of 7.7x—lower than Goldcorp and Newmont Mining.

ABX’s management’s focus on reducing its leverage has acted as a positive catalyst over the past two years. Its unit costs are also among the lowest in the industry, which should work in its favor going forward, potentially leading to a re-rating.

Kinross Gold

Finally, Kinross Gold (KGC) is trading at the lowest forward multiple of 4.8x, though its EBITDA margin estimates are also the lowest among peers at 36%, mainly due to its higher unit costs and lower grades. Geopolitical risks and KGC’s unstable production profile are, of course, always weighing on investors’ minds.

Notably, Barrick Gold and Newmont Mining account for 6.2% and 6.7%, respectively, of the VanEck Vectors Gold Miners ETF (GDX).