Inside the Recent Role of Volatility in Gold

The volatility index may finally stop being stagnant and move upward, now that the fiasco of the GOP’s healthcare bill attempt failed to launch on March 24.

March 28 2017, Published 1:58 p.m. ET

Reduced volatility

The volatility index may finally stop being stagnant and move upward, now that the fiasco surrounding the Republican attempt to repeal and replace President Obama’s Affordable Care Act reached a head on Friday, March 24. The volatility index (VXZ), CBOE Volatility Index (VIX) has been trading close to 12% for the past few months.

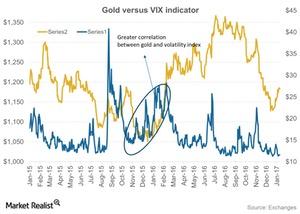

As shown in the chart below, gold and volatility are often seen moving in tandem, but the two can also deviate from each other, which is what we’ve seen most recently. Despite the falling volatility in markets, gold (SGOL) and silver (SIVR) have seen price upswings of 8.2% and 10.6%, respectively.

Gold and VIX

Higher unrest in markets calls for safe-haven demands, and as a result, precious metals perform better. At the same time, monetary policies across the globe stopped tightening, and gold got a boost. Remember, precious metals often perform well amid monetary expansion.

But as the Trump administration’s pro-growth policies may not unfold as expected, there are chances that VIX will break its shackles and rise. However, once again, gold and VIX could track each other, and gold could also witness a further upswing.

Market sentiment reigns

However, the most important driver for gold lately has been overall market sentiment. Market volatility often gives a positive kick to gold, and precious metals’ safe-haven appeal comes into play when investors look for safety during volatile times.

Notably, mining companies Aurico Gold (AUQ), Agnico-Eagle Mines (AEM), Randgold Resources (GOLD), and Newmont Mining (NEM) are among those that tend to track price changes in gold.