How Does Merck’s Valuation Compare to Peers?

On a capital-structure-neutral basis, Merck currently trades at ~9.6x, which is much lower than the industry average of ~11.2x.

March 24 2017, Published 4:16 p.m. ET

A look at Merck’s valuation

Headquartered in New Jersey, Merck (MRK) is one of the oldest and largest pharmaceutical companies by revenue. For more details about Merck, read Merck and Company: An American Pharmaceuticals Giant.

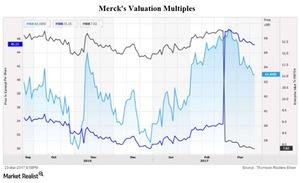

The fundamental factors affecting stock prices and valuations include the performance of existing products, new and existing collaborations, and other factors including results of clinical trials and product approvals. This series covers the performance of existing products as well as other factors driving revenues for the company. We believe forward PE and EV-to-EBITDA multiples are two of the best valuation multiples to use when valuing Merck and other large pharmaceutical companies, given the relatively stable and visible nature of their earnings.

Forward PE

PE multiples are widely available and represent what one share can buy for an equity investor. On March 23, 2017, the company was trading at a forward PE multiple of ~16.3x.

Merck’s valuation multiple has also followed the industry’s overall trend over the last five years. Whether the healthcare sector’s forward PE multiple rises or falls, Merck will definitely be affected. The industry currently trades at a forward PE multiple of ~16.4x. Other competitors such as Johnson & Johnson (JNJ), Pfizer (PFE), and Eli Lilly and Co. (LLY) have forward PE multiples of 17.9x, 13.1x, and 20.1x, respectively.

EV to EBITDA

On a capital-structure-neutral basis, Merck currently trades at ~9.6x, which is much lower than the industry average of ~11.2x. Other competitors such as Johnson & Johnson (JNJ), Pfizer (PFE), and Eli Lilly (LLY) have forward EV-to-EBITDA multiples of 12.1x, 10.2x, and 14.3x, respectively.

To divest the risk, investors can consider ETFs like the iShares S&P Global 100 ETF (IOO), which holds 1.8% of its total assets in Merck.