Coca-Cola, PepsiCo, Dr Pepper Snapple: A Valuation Showdown?

As of March 28, Coca-Cola and PepsiCo were trading at 12-month forward PE multiples of 22.7x and 22.0x, respectively.

Nov. 20 2020, Updated 4:33 p.m. ET

Current valuation

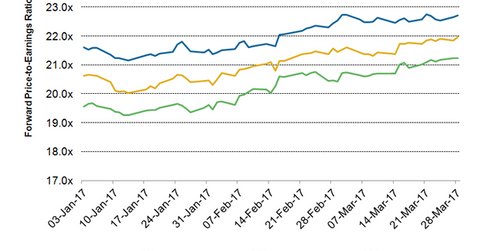

As of March 28, Coca-Cola (KO) and PepsiCo (PEP) were trading at 12-month forward PE (price-to-earnings) multiples of 22.7x and 22.0x, respectively. Smaller peer Dr Pepper Snapple (DPS) was trading at a 12-month forward PE of 21.2x.

Remember, the 12-month forward PE is calculated by dividing a company’s current stock price by its forecasted EPS (earnings per share) for the next four quarters. The 12-month forward PE differs among peers based on several factors, including their business models, growth expectations, and risk-return profiles.

Comparison with sector

As of March 28, the S&P 500 Consumer Staples Index was trading at a 12-month forward PE of 21.3x. Currently, Coca-Cola and PepsiCo are trading at a higher valuation multiple than the S&P 500 Consumer Staples Index. They are also trading at a higher valuation multiple than the 18.7x of the S&P Index (SPX) (SPY).

Coca-Cola, PepsiCo, and Dr Pepper Snapple together constitute 14.6% of the Consumer Staples Select Sector SPDR Fund (XLP).

Coke’s growth expectations

Analysts expect Coca-Cola’s revenue to fall 16.4% to about $35.0 billion in fiscal 2017. Currency headwinds, structural items (such as the refranchising of bottling operations), and acquisitions and divestitures are expected to drag down 2017 revenues.

Analysts expect the company’s adjusted EPS (earnings per share) to fall 1.9% to $1.87. (Adjusted EPS excludes the impact of one-time items.)

Pepsi’s growth expectations

PepsiCo’s revenue is expected to rise 0.7% to $63.2 billion, and its adjusted EPS is expected to rise 5.7% to $5.13 in fiscal 2017. PepsiCo’s snack food business is helping the company to mitigate the impact of weak soda volumes, to a certain extent. The company is also trying to improve its margins through several productivity initiatives, including manufacturing automation.

Dr Pepper Snapple’s growth expectations

Analysts expect Dr Pepper Snapple’s sales to rise 5.1% to $6.8 billion in 2017. The company’s adjusted EPS is expected to rise 4.3% to $4.58.

Dr Pepper Snapple has a strong presence in the flavored carbonated soft drinks market. The company is now trying to expand its presence in the noncarbonated beverage space through innovation and with the help of allied brands.

For more updates, visit our Nonalcoholic Beverages page.