Are Sanofi’s Established Prescription Products Adding Up?

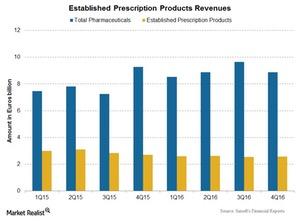

Sanofi’s (SNY) Established Prescription Products segment contributed nearly 30.5% of the company’s total revenues in 2016.

April 3 2017, Updated 10:40 a.m. ET

Established Prescription Products

Sanofi’s (SNY) Established Prescription Products segment contributed nearly 30.5% of the company’s total revenues in 2016. But the segment reported a 6.8% revenue fall YoY (year-over-year) at constant exchange rates to 10.31 billion euros (about $11.02 billion) in 2016.

These revenues were primarily impacted by lower sales of established products in the European markets, lower sales in Venezuela, and lower Plavix sales across all markets.

Plavix

Plavix, one of Sanofi’s big blockbuster drugs, is an anticoagulant used to prevent blood clots. Plavix reported revenues of 1.54 billion euros (about $1.65 billion) in 2016, which is a fall of 18.8% YoY at constant exchange rates, mainly impacted by a 50.0% YoY fall in revenues in the emerging markets.

Plavix competes with AstraZeneca’s (AZN) Brilianta, Eli Lilly’s (LLY) Effient, and Johnson & Johnson’s (JNJ) Xarelto.

Lovenox

Lovenox, an anticoagulant used in the treatment of reducing the formation of blood clots, reported a ~1.7% YoY revenue fall at constant exchange rates to 1.64 billion euros (about $1.75 billion) in 2016, following generic competition in US markets. Revenues are expected to remain nearly flat due to the entry of potential biosimilars in European markets.

Renvela and Renagel

Renvela and Renagel are used to control serum phosphorus in patients with chronic kidney disease on dialysis. These drugs had combined sales of 922 million euros (about $985.2 million) in 2016, which represents of 1.1% YoY fall at constant exchange rates.

US revenues rose ~5.5% to 764 million euros (about 816.3 million) during 2016. The drug is already exposed to generic competition in few European countries. Other drugs from this franchise include Aprovel/Avapro, Synvisc, Allegra, and Myslee.

Notably, to divest risk, investors can always consider ETFs like the First Trust Value Line Dividend ETF (FVD), which has 0.5% of its total assets in Sanofi.

Now let’s move to Sanofi’s Healthcare and Generics franchise.