What Do Analysts Recommend for Whiting Petroleum?

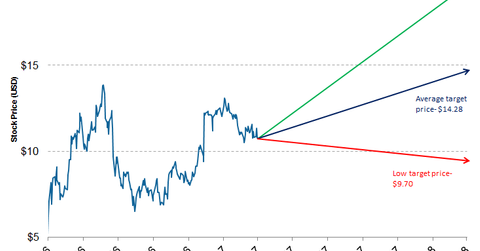

Approximately 38.5% of the analysts rated Whiting Petroleum (WLL) as a “buy,” while ~56.4% rated it as a “hold.” The average broker target price is $14.28.

March 6 2017, Updated 12:36 p.m. ET

Consensus ratings for Whiting Petroleum

Approximately 38.5% of the analysts rated Whiting Petroleum (WLL) as a “buy,” while ~56.4% rated it as a “hold.” The average broker target price of $14.28 for Whiting Petroleum implies a return of ~33% over the next 12 months.

Whiting Petroleum’s high target price stands at $19.00, while its low target price is ~$9.70.

Recent upgrades and downgrades

On December 1, Stifel upgraded its ratings for Whiting Petroleum from “hold” to “buy.” Whiting Petroleum’s peer Continental Resources (CLR) was recently downgraded by Deutsche Bank, J.P. Morgan (JPM), and KLR Group. On December 8, Deutsche Bank (DB) downgraded its rating for Continental Resources from “buy” to “hold.” On the same day, J.P. Morgan downgraded its rating for Continental Resources from “overweight” to “neutral.” KLR Group downgraded Continental Resources from “accumulate” to “hold” on December 5.