Will Upstream Operators’ Capex Affect Nabors’ 4Q16 Margin?

In the past couple of years, some of the major US upstream and integrated companies have reduced capital expenditure following crude oil prices’ sharp decline.

Feb. 17 2017, Updated 7:36 a.m. ET

Upstream operators’ capex cut

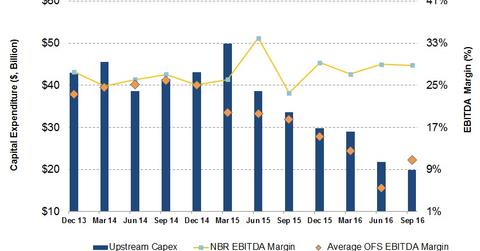

In the past couple of years, some of the major US upstream and integrated companies have reduced capital expenditure following crude oil prices’ sharp decline. From 4Q15 to 4Q16, 18 of the most prominent names in this space have slashed capex by 43% in total. Lower upstream capex resulted in lower prices for oilfield services and equipment (or OFS) companies’ services and products, which reduced OFS companies’ operating revenues and margins.

From 3Q16 to 4Q16, these companies’ capex fell only 14%, as crude oil prices started to recover in 2016. Many of these companies have started to increase their 2017 capex budget. Read Market Realist’s Why Cabot Awaits the Atlantic and Constitution Pipeline Projects to know more. Higher capex on energy drilling and production can lead to improved margins for OFS companies going forward.

Nabors’ EBITDA margin versus industry

As shown in the graph above, Nabors Industries’ (NBR) EBITDA (earnings before interest, tax, depreciation, and amortization) margin was not very affected even as upstream companies slashed budgets. From 3Q15 to 3Q16, NBR’s EBITDA margin (or EBITDA as a percentage of revenues) was resilient at ~29%. Eight of the most prominent OFS companies’ average EBITDA margins fell to 2.6% in 4Q16 from 10.8% in 3Q16. EBITDA margin is a measure of a company’s operating earnings. NBR makes up 0.25% of the iShares North American Natural Resources ETF (IGE).