What Higher Capacity Means for Airlines’ Utilization

The load factor Airlines’ capacity utilization is measured using the passenger load factor, which is calculated by dividing traffic by capacity. Analyzing airlines’ load factors As discussed in the previous article, most airlines saw high capacity growth in January 2017. As a result, all airlines except JetBlue Airways witnessed a decline in their load factors. […]

Feb. 20 2017, Updated 3:02 p.m. ET

The load factor

Airlines’ capacity utilization is measured using the passenger load factor, which is calculated by dividing traffic by capacity.

Analyzing airlines’ load factors

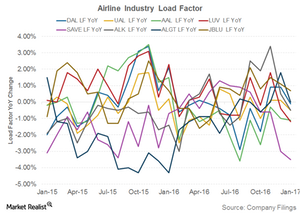

As discussed in the previous article, most airlines saw high capacity growth in January 2017. As a result, all airlines except JetBlue Airways witnessed a decline in their load factors.

Delta Air Lines’ (DAL) utilization fell 0.1 percentage points to 81.2%. United Continental’s (UAL) and Alaska Airlines’ (ALK) utilization fell 0.5 percentage points each, to 80.4% and 78.1%, respectively. American Airlines’ (AAL) utilization fell 1.1 percent points to 78.6%, and Southwest Airlines (LUV) saw a 1.2-percentage-point fall in utilization to 76.3%. Spirit Airlines (SAVE) had the largest fall in utilization of 3.5 percentage points, to 78.2%. Conversely, JetBlue Airways improved its utilization by 0.7 percentage points to 83.3%.

What can we expect?

In fiscal 2016, Spirit Airlines, Alaska Airlines, JetBlue, and Southwest Airlines all saw their utilization improve. With airlines paying more attention to improving their unit revenue, capacity growth is expected to remain subdued in 2017, resulting in improved utilization. However, Spirit Airlines, which continues to increase its capacity by high double digits, will continue to lower its utilization and add pressure on its unit revenue.

Investors can gain exposure to the iShares Transportation Average ETF (IYT), which invests 23% of its portfolio in airlines. Next, we’ll analyze the impact of crude oil prices on airlines.