Backwardation: What It Could Mean for Crude Oil Prices

When the crude oil futures forward curve to slopes downwards, the situation in the crude oil futures market is called “backwardation.”

Nov. 20 2020, Updated 5:30 p.m. ET

Contango and oil prices

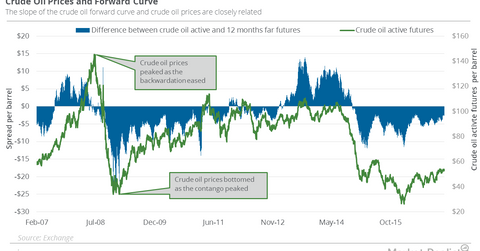

Active crude oil (USO) (USL) futures are currently trading at a discount of $2.63 to the futures contracts 12 months ahead. The situation is called “contango” in the crude oil futures market. It represents an upward sloping shape on the futures forward curve. It represents markets’ sentiment for a lack of demand for crude oil and lower prices, but the likelihood of higher demand and higher prices in the future.

Historically, periods of weak crude oil prices coincided with the contango structure. Recently, the crude oil forward curve switched to the contango structure in November 2014. Since then, crude oil active futures have fallen ~33.7%.

Backwardation and oil prices

On the other hand, when there’s an immediate demand for crude oil, active crude oil futures trade at higher prices than the futures contracts for the months ahead. It causes the crude oil futures forward curve to slope downwards. The situation in the crude oil futures market is called “backwardation.”

Historically, periods of strong crude oil prices coincided with the backwardation structure. Crude oil (SCO) (UCO) active futures closed at $145.29 per barrel on July 3, 2008—historic highs after an almost one-year period of backwardation in the oil market. Active crude oil futures traded at a premium of $9.24 to futures contracts 12 months ahead at the peak on November 2, 2007. As the forward curve switched to contango during the following year, with active futures hitting a discount of $21.41 to futures contracts 12 months ahead, crude oil prices lost 76.6%.

So, the shape of the futures forward curve in the oil market can hint at coming changes in oil prices.

Impact of the crude oil forward curve

Since OPEC’s historic deal, the contango structure in the oil market has been flattening. The fall in the spread could point to tightening in the crude oil demand-supply balance. It could mean that the market sees higher prices coming in the spot crude oil market.

The dynamics of the crude oil forward curve can have implications on oil storage master limited partnerships (AMLP). They could impact upstream oil producers’ (XOP) hedging decisions. The dynamics could have important implications for the performance of commodity tracking ETFs such as the United States Oil (USO). Due to the contango structure in the oil market lately, USO underperformed crude oil prices. It could change if the oil market switched to backwardation.

Oil’s forward curve could also be an important catalyst for broader markets (SPY) (QQQ).

In the next part, we’ll look at the relationship between crude oil inventories and crude oil prices.