Understanding BHP Billiton’s Earnings Beat in Fiscal 2H17

BHP’s underlying net profit of $3.2 million was a solid improvement, as compared to the profit of $412 million in 4Q15.

Nov. 20 2020, Updated 12:22 p.m. ET

Results beat expectations

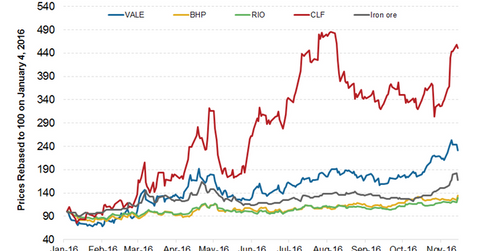

On February 21, 2016, BHP Billiton (BHP) (BBL) reported results for the first half of fiscal 2017. Fiscal 2017 will end on June 30, 2017. BHP’s results beat the market expectations due to the rebound in commodity prices and productivity gains.

Its underlying net profit of $3.2 million was a solid improvement, as compared to the profit of $412 million in the same period last year. It also higher than consensus expectations of $3 billion.

The company also declared dividends of $0.4 per share, which was $0.1 per share higher than the minimum payment under the company’s policy of 50% payout from underlying earnings.

Peers’ results

Vale (VALE) will report its results on February 23, 2017. Before its results announcement, the stock price remains strong as the company announced that it would create a single class of stock without a controlling shareholder. Cliffs Natural Resources (CLF), mainly a US focused iron ore player, announced its 4Q16 results on February 9, 2017, beating market expectations by a huge margin.

Rio Tinto (RIO) announced its results for the half year (ended December 2016) on February 8, 2017. Its results also beat analysts’ estimates. It also announced to go for a $500-million share buyback.

Analysis of results

In this series, we’ll analyze BHP’s earnings for the first half of fiscal 2017. We’ll also discuss the management team’s volatile commodity price (COMT) environment.

To read about BHP’s production results for 2016 and guidance for 2017, please visit BHP’s Commodity Prices Remain Strong: How is BHP Billiton Doing?

In the next part of the series, we’ll see if BHP Billiton can catch up with Rio Tinto in iron ore unit costs.