Will Upstream Operators’ Capex Affect Flotek’s 4Q16 Margin?

In the past couple of years, some of the major US upstream and integrated companies have reduced capital expenditure as a result of crude oil’s sharp decline.

Jan. 19 2017, Updated 9:06 a.m. ET

Upstream operators’ capex cut

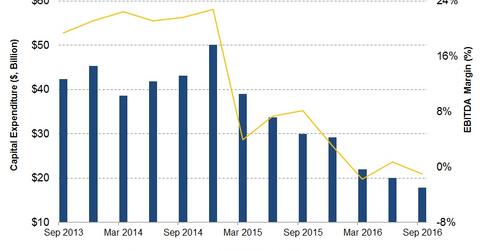

In the past couple of years, some of the major US upstream and integrated companies have reduced capital expenditure as a result of crude oil’s sharp decline. From 3Q15 to 3Q16, 19 of the most prominent names in this space slashed capex by 41%, in aggregate. Lower upstream capex resulted in lower prices for oilfield services and equipment (or OFS) companies’ services and products, which reduced OFS companies’ operating revenues and margins.

From 2Q16 to 3Q16, these companies’ capex fell only 11%, as crude oil prices started to recover in 2016. Many of these companies have started to increase their 2017 capex budget. Read Market Realist’s Why Cabot Awaits the Atlantic and Constitution Pipeline Projects to know more. Higher capex on energy drilling and production can lead to improved margins for OFS companies going forward.

Flotek’s EBITDA margin

As shown in the graph above, Flotek Industries’ (FTK) EBITDA (or earnings before interest, tax, depreciation, and amortization) margin was severely affected as upstream companies slashed their budgets. From 3Q15 to 3Q16, FTK’s EBITDA margin (or EBITDA as a percentage of revenues) was -1%. The EBITDA margin is a measure of a company’s operating earnings. FTK makes up 0.14% of the iShares Micro-Cap ETF (IWC).