iShares Micro-Cap

Latest iShares Micro-Cap News and Updates

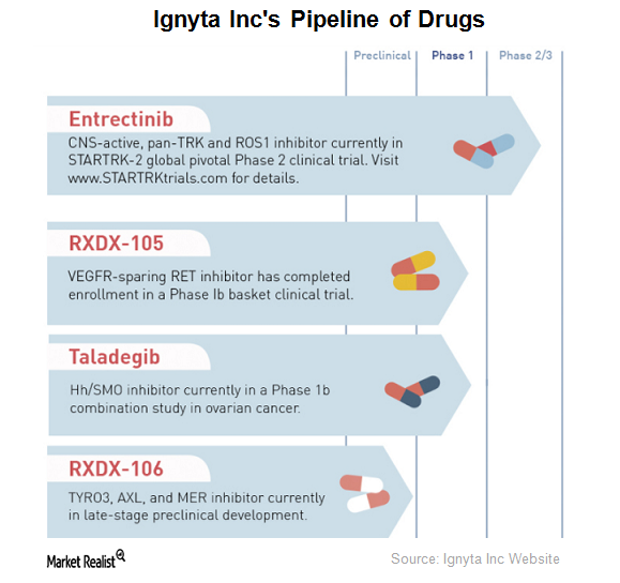

Ignyta’s Drug Pipeline

Ignyta (RXDX) has completed enrollment for a Phase 1 clinical trial of RXDX-105, an orally bioavailable small molecule tyrosine kinase inhibitor.

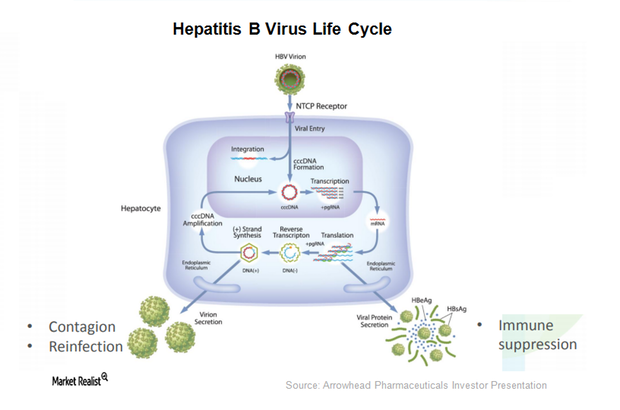

Arrowhead’s Candidates for Hepatitis B, Cardiovascular Diseases

ARO-HBV is Arrowhead Pharmaceuticals’ (ARWR) investigational drug candidate for treating chronic hepatitis B infection.

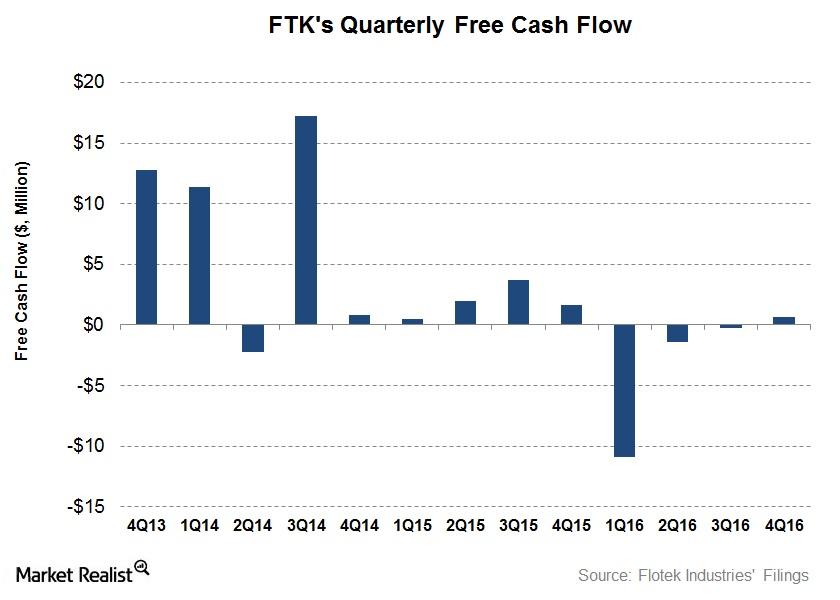

Flotek Industries’ Capex: Impact of a Credit Facility Agreement

In this article, we’ll analyze how Flotek Industries’ (FTK) operating cash flows trended over the past few quarters.

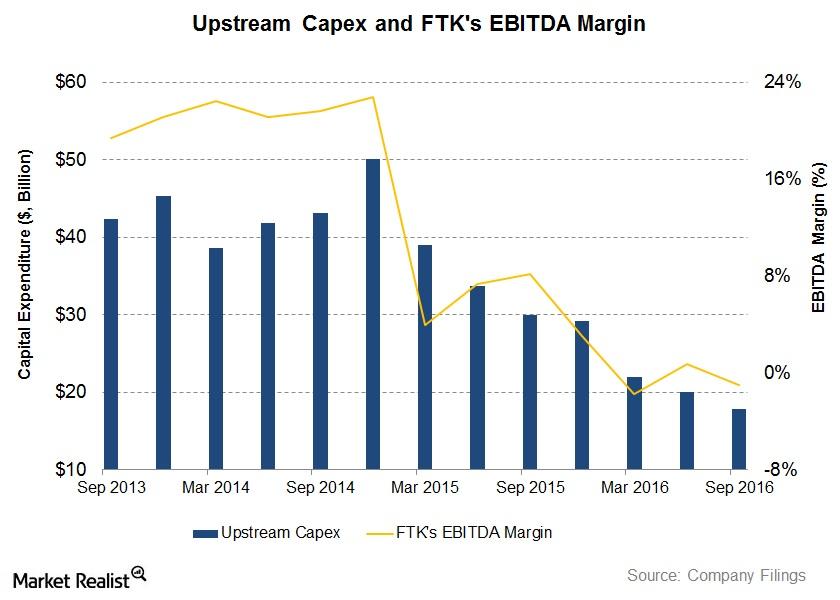

Will Upstream Operators’ Capex Affect Flotek’s 4Q16 Margin?

In the past couple of years, some of the major US upstream and integrated companies have reduced capital expenditure as a result of crude oil’s sharp decline.