Why Western Gas’s Capital Spending Could Recover in 2017

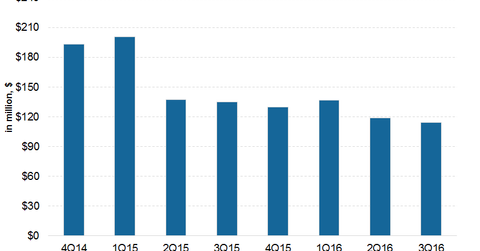

Western Gas Partners’ (WES) growth capital spending started to decline at the beginning of the rout in energy prices.

Jan. 23 2017, Updated 7:38 a.m. ET

Western Gas’s capex

Western Gas Partners’ (WES) growth capital spending started to decline at the beginning of the rout in energy prices due to decline in drilling activity by its sponsor, Anadarko Petroleum (APC) and other third-party producers. But growth in capital spending might resume with the slight recovery in drilling activity. WES is expected to spend mainly on gathering infrastructure and the expansion of its Ramsey Complex.

WES had five processing plants at the Ramsey complex as of the third quarter of 2016 and is planning to place Ramsey VI into service in the fourth quarter of 2017. After the completion of the Ramsey VI plant, the complex’s total processing capacity would increase to 900 Mcfpd (million cubic feet per day).

Western Gas’s Delaware focus

Notably, APC and other upstream producers are benefitting from declines in DC&E (drilling, completion, and exploration) costs in the region, which indirectly benefits WES.

According to WES Chief Executive Officer Donald Sinclair, “Anadarko [continues] to increase the thread count in the Delaware basin and is currently running eight rigs. Anadarko is forecasting over 130,000 net barrels of oil production per day by 2021 and we believe this will result in over 500 million cubic feet per day of natural gas production in excess of 500,000 barrels per day of produced water.”

Sinclair added: “As water volumes increase in [the] basin, significant additional pipeline infrastructure will be needed.” The partnership started working in the setup of two water disposal systems in 2016.

Peers EnLink Midstream Partners (ENLK), DCP Midstream Partners (DPM), and Crestwood Equity Partners (CEQP) are among the midstream MLPs that might benefit from a strong Delaware region focus.