Moody’s Rated Vector Group’s Secured Notes

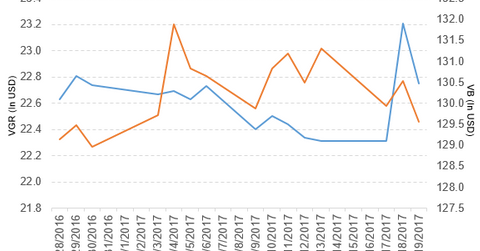

Vector Group (VGR) has a market cap of 2.9 billion. It fell 2.0% to close at $22.75 per share on January 19, 2017.

Jan. 23 2017, Updated 7:39 a.m. ET

Price movement

Vector Group (VGR) has a market cap of 2.9 billion. It fell 2.0% to close at $22.75 per share on January 19, 2017. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 1.4%, 2.6%, and 0.04%, respectively, on the same day.

VGR is trading 0.91% above its 20-day moving average, 5.4% above its 50-day moving average, and 11.3% above its 200-day moving average.

Related ETF and peers

The Vanguard Small-Cap ETF (VB) invests 0.07% of its holdings in Vector Group. The YTD price movement of VB was 0.46% on January 19.

The market caps of Vector Group’s competitors are as follows:

Latest news on Vector Group

On January 19, 2017, Moody’s reported, “Moody’s Investors Service (“Moody’s”) assigned a Ba3 (LGD 2) rating to Vector Group Ltd.’s (Vector) $850 million senior secured notes offering. The notes will mature in 2025. Net proceeds from this offering will be used to refinance the $835 million existing senior secured notes.

“The ratings on the existing secured notes will be withdrawn at the closing of this offering. The company’s B2 Corporate Family Rating and Stable outlook are unchanged.”

Performance of Vector Group in 3Q16

Vector Group reported 3Q16 total revenues of $459.1 million, a rise of 2.0% compared to total revenues of $449.9 million in 3Q15. Revenue from its E-cigarette and Real Estate segments fell 0.38% and 98.0%, respectively. Revenues from the Tobacco segment rose 3.8% in 3Q16 compared to 3Q15. The company’s operating margin narrowed 30 basis points in 3Q16 compared to 3Q15.

The company’s net income and EPS (earnings per share) rose to $23.2 million and $0.18, respectively, in 3Q16 compared to $12.5 million and $0.10, respectively, in 3Q15.

It reported adjusted EBITDA[1. earnings before interest, tax, depreciation, and amortization] and adjusted EPS of $78.9 million and $0.19, respectively, in 3Q16, a rise of 2.2% and 90.0%, respectively, compared to 3Q15.

Now, we’ll look at AptarGroup (ATR).