How Have Superior Energy’s Recommendations Changed before the 4Q16 Earnings?

On January 6, 2017, ~70% of the analysts tracking SPN recommended a “buy” or some equivalent for the stock, while ~30% of the analysts issued a “hold.”

Jan. 13 2017, Updated 10:36 a.m. ET

Wall Street’s recommendations for Superior Energy Services

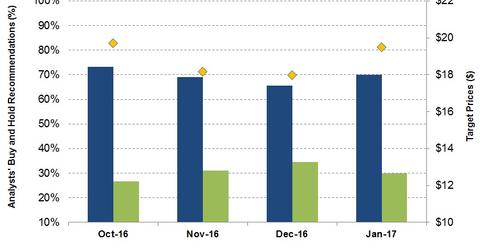

On January 6, 2017, approximately 70% of the analysts tracking Superior Energy Services (SPN) recommended a “buy” or some equivalent for the stock. Approximately 30% of the analysts tracking SPN have recommended a “hold,” while none rated a “sell.”

By comparison, approximately 45% of analysts tracking Core Laboratories (CLB) have recommended a “buy” or some equivalent for the stock as of January 6.

How the consensus “buy” percentage has changed for Superior Energy

From October 6, 2016, to January 6, 2017, the percentage of analysts recommending a “buy” or some equivalent for SPN has fallen from 73% to 70%. Analysts’ “hold” recommendations have increased for SPN in the past four months. One year ago, ~74% of sell-side analysts recommended a “buy” for SPN.

Notably, Superior Energy Services makes up 0.16% of the iShares North American Natural Resources ETF (IGE).

Analysts’ target prices for SPN and peers

Wall Street analysts’ median target price for SPN on January 6 was $20. SPN is currently trading at ~$18.7, implying ~7% upside at its current median price. One year ago, the average target price for SPN was $18.80.

By comparison, the mean target price as surveyed among sell-side analysts for Tidewater (TDW) was $3.63 on January 6. TDW is currently trading at ~$3.6, implying nearly zero upside potential at its average target price. The mean target price as surveyed among the sell-side analysts for FMC Technologies (FTI) was ~$35.5 on January 6. FTI is currently trading at ~$36.4, which implies 3% downside at its average price.

You can learn more about the OFS (oilfield services and equipment) industry in Market Realist’s series The Oilfield Equipment and Services Industry: A Primer.