Comparing PotashCorp’s Enterprise Multiple with Its Peers

PotashCorp (POT), which is currently trading at an EV-t0-EBITDA multiple of 15.0x, is trading far above its low point of 6.0x a year ago.

Jan. 23 2017, Updated 10:35 a.m. ET

PotashCorp’s enterprise multiple

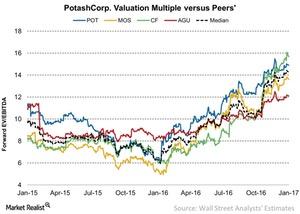

With the hope that the agribusiness sector, particularly fertilizers, will soon see a turnaround, some stocks have risen. The median valuation of four major agricultural fertilizer companies has seen an upward trend.

As of January 17, 2017, the median valuation multiple for EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) was 14.3x.

EV-to-EBITDA multiples

The median (NANR) multiple of the four stocks in the above graph has risen from the low point of 6.0x in January 2016. The earnings reports of those companies may have hinted of a turnaround in the coming year in terms of demand.

PotashCorp (POT), which is currently trading at an EV-t0-EBITDA multiple of 15.0x, is trading far above its low point of 6.0x a year ago. The company is trading close to its highest EV-to-EBITDA multiple of 15.5x last year.

Peer multiples

Similar to PotashCorp, the remaining three stocks in the above graph are also trading close to their highest EV-to-EBITDA multiples. Mosaic (MOS) is trading at an EV-to-EBITDA multiple of 13.6x, far above 5.0x around the same time a year ago.

CF Industries (CF) is trading at 15.7x, which has also risen from its low point of 6.0x a year ago. Agrium (AGU), which is waiting to merge with PotashCorp, is trading at an EV-to-EBITDA multiple of 12.1x. Its low point a year ago was 8.0x.

In the next and final part of this series, we’ll look at analysts’ recommendations and price targets for PotashCorp for the next 12 months.