Why Look to REITs for Opportunities?

HEDGING AGAINST INFLATION Property stocks and REITs have often been viewed as inflation hedges because expected inflation will affect prices of real estate, and rental income tends to rise along with generalized inflation. However, other factors may mitigate the impact of inflationary forces. Some of these additional factors may include real estate supply and demand […]

Dec. 22 2016, Updated 10:38 a.m. ET

HEDGING AGAINST INFLATION

Property stocks and REITs have often been viewed as inflation hedges because expected inflation will affect prices of real estate, and rental income tends to rise along with generalized inflation. However, other factors may mitigate the impact of inflationary forces. Some of these additional factors may include real estate supply and demand dynamics, interest rates, government policies or even war. Thus, a diversified basket of assets may be necessary to properly hedge against inflation.

CONCLUSION

REITs were designed to provide individual investors with liquid investment opportunities in real estate. The increased breadth and depth of sector coverage in the U.S. combined with continued global expansion of property stocks and REITS has led to the development of a more robust and sophisticated asset class. Moreover, potentially high dividend yields, inflation hedging attributes and modest correlations with traditional asset classes may serve to reinforce the potential benefits of including property stocks and REITs within a portfolio context.

Market Realist’s View

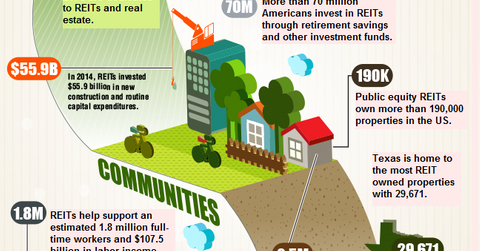

The infographic above from NAREIT shows how the REIT sector (VNQ) impacts the US economy in a big way.

As we discussed in the previous parts of this series, not only do REITs (RWR)(ICF) help diversify a portfolio, but they also bolster portfolio income with their steady dividends and their long-term capital appreciation. The REITs sector outclasses the performance of the broader market over the long term. The FTSE NAREIT All Equity REITs Index was up by a robust 13.8% through September 1, 2016, whereas the S&P 500 was up only 7.8%.

Anxieties about a rate hike tend to pull down the REIT sector (IYR). However, this trend may not be as much of a factor this year since the rate hike is expected to be moderate and slow. As long as rate hikes accompany economic improvement, equity REITs (SCHH) should continue to flourish. Given the stable jobs market and the increase in occupancy levels in the real estate sector, REIT investors may have no reason to worry.

However, cautious investors can always turn to healthcare REITs instead. As the population continues to age, the need for healthcare facilities continues to rise. This trend could prove to be a tailwind for healthcare REITs in the long term.

Given their stellar performance track record, inflation protection and diversification benefits, and stable dividend returns, REITs may be a good long-term investment.